http://www.rollingstone.com/politics/news/how-wall-street-killed-financial-reform-20120510

All,

The biggest and by far the most important and relevant story in all of American politics (and economics) today. The massive tragedy is that relatively few people are even paying any attention at all given the ongoing sideshow spectacle of the upcoming presidential elections whose outcome will--as always--be ruthlessly controlled and criminally directed by the super wealthy elites represented by the banks, corporations, and other Wall Street financial institutions no matter who "wins" the election. As usual the brilliant political journalist and economic analyst Matt Taibbi does a masterful and very revealing job of telling us exactly how and why this is so and what it really means...

Kofi

How Wall Street Killed Financial Reform

It's bad enough that the banks strangled the Dodd-Frank law. Even worse is the way they did it - with a big assist from Congress and the White House.

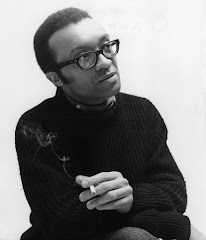

by Matt Taibbi

May 10, 2012

Rolling Stone

Two years ago, when he signed the Dodd-Frank Wall Street Reform and Consumer Protection Act, President Barack Obama bragged that he'd dealt a crushing blow to the extravagant financial corruption that had caused the global economic crash in 2008. "These reforms represent the strongest consumer financial protections in history," the president told an adoring crowd in downtown D.C. on July 21st, 2010. "In history."

This was supposed to be the big one. At 2,300 pages, the new law ostensibly rewrote the rules for Wall Street. It was going to put an end to predatory lending in the mortgage markets, crack down on hidden fees and penalties in credit contracts, and create a powerful new Consumer Financial Protection Bureau to safeguard ordinary consumers. Big banks would be banned from gambling with taxpayer money, and a new set of rules would limit speculators from making the kind of crazy-ass bets that cause wild spikes in the price of food and energy. There would be no more AIGs, and the world would never again face a financial apocalypse when a bank like Lehman Brothers went bankrupt.

Most importantly, even if any of that fiendish crap ever did happen again, Dodd-Frank guaranteed we wouldn't be expected to pay for it. "The American people will never again be asked to foot the bill for Wall Street's mistakes," Obama promised. "There will be no more taxpayer-funded bailouts. Period."

Two years later, Dodd-Frank is groaning on its deathbed. The giant reform bill turned out to be like the fish reeled in by Hemingway's Old Man – no sooner caught than set upon by sharks that strip it to nothing long before it ever reaches the shore. In a furious below-the-radar effort at gutting the law – roundly despised by Washington's Wall Street paymasters – a troop of water-carrying Eric Cantor Republicans are speeding nine separate bills through the House, all designed to roll back the few genuinely toothy portions left in Dodd-Frank. With the Quislingian covert assistance of Democrats, both in Congress and in the White House, those bills could pass through the House and the Senate with little or no debate, with simple floor votes – by a process usually reserved for things like the renaming of post offices or a nonbinding resolution celebrating Amelia Earhart's birthday.

The fate of Dodd-Frank over the past two years is an object lesson in the government's inability to institute even the simplest and most obvious reforms, especially if those reforms happen to clash with powerful financial interests. From the moment it was signed into law, lobbyists and lawyers have fought regulators over every line in the rulemaking process. Congressmen and presidents may be able to get a law passed once in a while – but they can no longer make sure it stays passed. You win the modern financial-regulation game by filing the most motions, attending the most hearings, giving the most money to the most politicians and, above all, by keeping at it, day after day, year after fiscal year, until stealing is legal again. "It's like a scorched-earth policy," says Michael Greenberger, a former regulator who was heavily involved with the drafting of Dodd-Frank. "It requires constant combat. And it never, ever ends."

That the banks have just about succeeded in strangling Dodd-Frank is probably not news to most Americans – it's how they succeeded that's the scary part. The banks followed a five-point strategy that offers a dependable blueprint for defeating any regulation – and for guaranteeing that when it comes to the economy, might will always equal right.

STEP 1: STRANGLE IT IN THE WOMB

The first advantage the banks had lay in the fact that for all Obama's bluster, Dodd-Frank was never such a badass law to begin with. In fact, Obama's initial response to the devastating financial events of 2008 represented a major departure from the historical precedent his own party had set during the 1930s, when President Franklin D. Roosevelt launched an audacious rewrite of the rules governing the American economy following the Great Crash of 1929.

Upon entering office, FDR was in exactly the same position Obama found himself in after his inauguration in 2009. Then, as now, the American economy was in tatters after the bursting of a massive financial bubble, brought on when speculators borrowed huge sums and gambled on unregistered securities in largely unregulated exchanges. This mania for instant riches led to an explosion of Wall Street fraud and manipulation, creating a mountain of illusory growth divorced from the real-world economy: Of the $50 billion in securities sold in America in the 1920s, half turned out to be worthless.

Roosevelt's response to all of this was to pass a number of sweeping new laws that focused on a single theme: protecting consumers by forcing the business of Wall Street into the light. The Securities Act of 1933 required all publicly traded companies to register themselves and offer prospectuses to investors; the Securities Exchange Act of 1934 forced publicly traded companies to make regular financial disclosures; and the Commodity Exchange Act of 1936 required all commodities and futures to be traded on organized exchanges. FDR also created the FDIC to protect bank depositors (through an insurance fund paid for by the banks themselves) and passed the Glass-Steagall Act to separate insurance companies, investment banks and commercial banks. Post-New Deal, if you put money in a bank, you knew it was safe, and if you bought stock, you knew what you were buying.

This reform strategy worked for more than half a century – and it offered Obama a clear outline of how to respond to the crash he faced. What made 2008 possible was that Wall Street had moved its speculative frenzy away from the regulated exchange system created by FDR, and into darker, less-regulated markets that had coalesced around brand-new financial innovations like credit default swaps and collateralized-debt obligations. It wasn't that the old system had broken down; Wall Street had just moved the playground.

All Obama needed to do to rescue the economy and protect consumers was to make sure that the new playground had some rules. That meant moving swaps and other derivatives onto open exchanges, making sure that federally insured banks that dabbled in those dangerous markets retained more capital, and coming up with some kind of plan to prevent the next AIG or Lehman Brothers disaster – i.e., a plan for unwinding failing companies that wouldn't require federal bailouts.

The initial proposal for Dodd-Frank addressed most of those concerns. As drafted, it would have created a system for shutting down failing megafirms, required swaps to be traded and cleared on regulated exchanges, and restored the spirit of Glass-Steagall through the so-called Volcker Rule, which would have prevented federally insured banks from engaging in dangerous speculation. It envisioned a powerful new Consumer Financial Protection Bureau to represent the interests of consumers against Wall Street, a bureau headed not by some banker stooge but by an actual consumer advocate and financial expert like Elizabeth Warren, the Harvard professor who came up with the idea. And it would have cleaned up the mortgage markets by ending predatory home-lending and forcing everyone in the market, from homeowners to banks to investors buying mortgage securities, to post real cash and keep "skin in the game" when buying or selling a mortgage.

Then, behind the closed doors of Congress, Wall Street lobbyists and their allies got to work. Though many of the new regulatory concepts survived in the final bill, most of them wound up whittled down to such an extreme degree that they were barely recognizable in the end. Over the course of a ferocious year of negotiations in the House and the Senate, the rules on swaps were riddled with loopholes: One initially promising rule preventing federally insured banks from trading in risky derivatives ultimately ended up exempting a huge chunk of the swaps market from the new law. The Volcker Rule banning proprietary gambling survived, but not before getting its brains beaten out in last-minute conference negotiations; Wall Street first won broad exemptions for mutual funds, insurers and trusts, and then, with the aid of both Treasury Secretary Tim Geithner and Sen. Chuck Schumer of New York, managed to secure a lunatic and arbitrary numerical exemption that allows banks to gamble up to three percent of their "Tier 1" capital, a number that for big banks stretches to the billions.

Then there was the Consumer Financial Protection Bureau, which went from being a powerful, independent agency run by Elizabeth Warren to a smaller bureau within the Federal Reserve System run by - well, anyone but Elizabeth Warren. With Geithner and Republicans in Congress blocking her once-inevitable appointment, we no longer had Warren playing watchdog to Federal Reserve chief Ben Bernanke - instead we had new CFPB head Richard Cordray, a former Ohio attorney general who enjoys far less of a popular mandate than Warren, forced to operate within the bureaucracy of Bernanke's Fed.

But the best example of how the watering-down process helped make Dodd-Frank ripe for a later killing was the question of Too Big to Fail. Obama, Geithner and the Democratic leadership in Congress never seriously entertained enacting the most obvious and necessary reform at all – breaking up the so-called "systemically important financial institutions" (the congressional term for "banks so huge we'll have to bail them out if they collapse"). Rather than simply stopping these firms from getting so big that they'd blow up the universe in a collapse, the Democrats opted for a half-clever semantic trick, claiming they had solved the future bailout question with Title II of the Dodd-Frank Act, known as the "Orderly Liquidation Authority" or "OLA" section of the bill.

In a nod to FDR, Title II would have forced major financial companies to pay $19 billion into an FDIC-style fund that would cover the cost of any future bailouts. But then the balance of power in the Senate was upset by the election of Republican Scott Brown to Ted Kennedy's seat in Massachusetts. As the clock wound down toward the bill's passage, Brown insisted on a change: Instead of making ginormous companies pay $19 billion in advance, the FDIC would first use taxpayer money to pay for any bailouts, and then spend years trying to recover that money from Wall Street by means of an assessment process so convoluted that you could grow a four-foot beard in the time it would take to understand it. Republicans managed to wrangle support, in conference, for the "bailout now, pay later" idea, and it made its way into the final bill.

Fast-forward to 2012. Rep. Paul Ryan, the self-styled Edward Scissorhands of Republican budget slashing, gathers the GOP leadership together and tells the chairman of each committee that he wants them, collectively, to come up with $261 billion in cuts. Ryan demands $35 billion of the cuts come from the Financial Services Committee, which oversees much of the regulatory apparatus that would enforce Dodd-Frank. The committee is now chaired not by the reform bill's namesake, Rep. Barney Frank, but by median-intellected Spencer Bachus of Alabama, who last year voted to delay Dodd-Frank reforms designed to prevent swaps disasters like the one that drove his home turf of Jefferson County into bankruptcy.

Bachus' solution to coming up with massive budget cuts? Eliminate the entire Title II section of Dodd-Frank. If another bank failed, Bachus argued, it would take way too long to recoup the bailout money from Wall Street through that crazy assessment process that Republicans themselves had insisted on only two years earlier. In the end, the logic went, taxpayers would wind up footing the bill anyway, so better just to scrap the entire plan to have the FDIC pay for the bailouts upfront – thus "saving" taxpayers some $22 billion.

The logic, of course, is complete nonsense. Without Title II, we'd be right back where we started – rushing to implement an expensive bailout in the midst of a crisis, without any way to make Wall Street repay the money. But because Democrats had preemptively surrendered on the original idea of forcing Wall Street to pay into an FDIC-style kitty ahead of time, Republicans were now in a position to push the whole bailout plan off the pier via a simple budget resolution.

To make up the rest of the $35 billion in budget cuts ordered by Paul Ryan, Bachus also proposed slashing Obama's mortgage-aid program and making the Consumer Financial Protection Bureau subordinate to a congressional appropriations process – meaning that its budget could be subjected to never-ending attacks by the GOP. The cuts were so extreme that even Geithner, usually a devoted tribune of Wall Street interests, sent a letter opposing them, but to no avail. The budget-slashing resolution passed the House this April.

The problem with attacking laws in Congress, of course, is that you need to control both chambers to make it stick. The Bachus-budget gambit may not have much of a chance of passing in the Senate, which is still controlled by the Democrats, but that won't faze opponents of Dodd-Frank, who have found an even more dependable arena for gutting the new law:

STEP 2: SUE, SUE, SUE

While death and taxes may be only relative certainties in today's economy – failing megabanks neither die nor pay taxes anymore – one thing that was always absolutely certain from the start was that Wall Street was going to sue the living hell out of Washington before the ink was even dry on Dodd-Frank. It took a little while, but the banks very quickly found a tried-and-true method of tying up the reforms in court.

Wall Street's first big win involved a small-but-important change known as the "proxy access" rule, which made it easier for people who own stakes in a company to remove directors from the board – giving shareholders more power to rein in corrupt or overpaid company executives. More democracy in business sounded like a good idea to almost everyone. But Wall Street has a dependable playbook for getting rid of any reform, no matter how small, that leads to greater accountability. "First, they hire a shit-ton of lobbyists to go to the regulators," says Jim Collura, spokesman for the Commodity Markets Oversight Coalition. "Then, they beat the crap out of them during the rulemaking process. And then, when that's over, they litigate the hell out of them."

Sue their asses! For all the right's supposed hatred of "activist judges," conservatives immediately flocked to the courts in search of magistrates willing to casually overturn the work of elected officials. In the case of the proxy access rule, Wall Street convinced its two favorite lobbying arms, the Business Roundtable and the Chamber of Commerce, to sue the Securities Exchange Commission over a technicality, claiming that the agency had not done a proper cost-benefit analysis before it instituted the new rule. In an appropriately loathsome touch, the Chamber's legal team was led by one Eugene Scalia, son of Supreme Court Justice Antonin Scalia. The younger Scalia, who looks like the product of a twisted test-tube experiment that crossed his father with Ari Fleischer, pitched a federal appeals court on the idea that the proxy access rule was "arbitrary and capricious," and that the SEC hadn't spent enough time studying the rule's effects on "efficiency, competition and capital formation."

In fact, the agency had produced 60 pages of cost-benefit analysis and had spent, according to SEC chief Mary Schapiro, some 21,000 man-hours working on the bill and studying its effects. Still, the court wasn't impressed. In his opinion, presiding judge and Reagan appointee Douglas Ginsburg peed all over Dodd-Frank, vacating the rule, which he dismissed as "unutterably mindless." With striking chutzpah, considering that he was ruling in a case brought by the mother of all special interest lobbies, Ginsburg also denounced the shareholder rule as a gift to special interests, particularly "unions and government pension funds."

Almost immediately after the win, the gloating Scalia issued a thinly veiled threat to regulators, letting them know that any attempt to implement more limits on Wall Street would likely result in the same kind of lawsuit. "I would hope the agencies are taking to heart the potential consequences for Dodd-Frank rules," he chirped.

The success of the lawsuit cemented Wall Street's strategy for doing away with Dodd-Frank. Rather than challenge the constitutionality of the bill in one broad suit, the finance industry would take the bill apart by pulling out one fingernail at a time. "Dodd-Frank is not one thing but many," Margaret Tahyar, a partner at the white-shoe corporate defense firm Davis Polk, told reporters last year. "There is no reasonable constitutional or statutory challenge on the whole – only on the bits and pieces."

Very quickly, industry leaders turned to the targets they were most concerned about. This time, two bank-friendly industry groups sued the Commodity Futures Trading Commission (CFTC) to stop it from implementing "position limits" in the derivatives market. Unlike the proxy access rule, which was essentially a procedural issue, position limits got right to the heart of a monstrous international problem – the perversion of fuel and food prices by financial speculators. The oil bubble of 2008, in which a barrel of oil rose to a preposterous $146 before falling to an equally preposterous $35, was one result of such wanton speculation; the surge in global food prices that led to the Middle East revolutions last year was another.

The position limits set by Dodd-Frank were designed to prevent any one speculator from controlling more than 25 percent of a commodities market at any given moment. To say that this is an issue that shouldn't be litigated over a technicality is an understatement; it's not a stretch to say that the viability of capitalism itself is at least partially at stake here. The rule, after all, would help ensure that prices are pegged to the real supply and demand of real producers and consumers, not to fantasy bets placed by market-monopolizing speculators. But the industry sued the CFTC over the exact same issue – the supposed lack of sufficient cost-benefit analysis – that the Chamber of Commerce used to derail the proxy access rule. And once again, the industry hired the ass-kicking Scalia, who argued that the CFTC had failed to provide "sufficient evidence" for its decision to establish position limits.

In an even more awesome demonstration of sheer balls, Scalia & Co. also argued that the CFTC's vote to establish position limits was invalid because one of the agency's commissioners, Michael Dunn, did not really believe in the law. Dunn had quit the CFTC to take a cushy job at a Wall Street-friendly law firm, and on the way out the door, he whined that he had only voted for position limits because Dodd-Frank forced him to, calling the rule a "cure for a disease that does not exist." So under the novel test offered by Scalia, rules like position limits – approved by Congress after months of debate – could be invalidated simply because a federal commissioner who signed off on the details wasn't emotionally on board at the moment of the rule's conception.

The lawsuit by Scalia & Co. succeeded in gumming up the works. The industry has tried to get the court to issue an immediate stay on the implementation of position limits, and the case is likely to drag on for months. Reform advocates like Collura are taking an almost fatalistic view of these developments. "Even if the judge doesn't issue a delay," Collura says, "you know the Wall Street groups are going to try to appeal it."

STEP 3: IF YOU CAN'T WIN, STALL

You might think otherwise, but it doesn't naturally follow that because a law has been passed by Congress and signed by the president, said law actually has to be implemented. With Dodd-Frank, the SEC took a brilliant approach to submarining one of its own regulations. The agency was supposed to begin enforcing the new proxy access rule by late 2010. Instead, in October 2010, it granted speculators a last-minute stay – essentially giving the Chamber of Commerce time to prepare its lawsuit to permanently kill the rule.

Position limits are another example. Dodd-Frank ordered the CFTC to begin enforcing the new rule no later than January 17th, 2011. But January 17th came and went, and – no position limits! Gary Gensler, the head of the CFTC and a former executive of Goldman Sachs, then announced that he hoped to implement the rule by September 2011. But September came and went, and soon it was 2012, and before you knew it, the CFTC, like the SEC, was in court, facing a lawsuit that would permanently kill the rule.

Even the president got into the stalling game. During the year of nonaction on position limits, the "disease that did not exist" – energy speculation – returned to ravage the American gasoline market. In the winter of 2011, oil soared above $100 a barrel, despite fundamentals of supply and demand that would have suggested a price drop. Obama blasted fuel speculators for the price hike and announced that he was creating the Oil and Gas Price Fraud Working Group to "root out any cases of fraud or manipulation in the oil markets." He added, in stern and stirring tones, "We're going to make sure that nobody is taking advantage of American consumers for their own short-term gain."

This was a curious decision. If Obama really wanted to stop speculation in the oil markets, he didn't need to create a brand-new task force that would have to start from scratch to deal with a hellishly complex problem that Congress and the CFTC had already spent years studying. "An easier way to deal with excessive oil speculation," one senior Senate aide explains, "is for the president to just pick up the phone, call Gary Gensler and say, 'The Dodd-Frank Act required you to put in strong position limits by January 17th, 2011. Get off your butt and act.'"

The Oil and Gas Working Group turned out to be a complete sham. In its year of ostensible existence, the panel met only a few times, then never bothered to convene again. One source on the Hill tells me that some of the members were not even aware that they'd been named to the task force for months. It was such a Potemkin committee that when oil prices once again shot up past $100 a barrel this year, Obama was hilariously forced to announce that he was "reconstituting" the task force, even though it had never officially disbanded. "It's a joke," says Greenberger, the former regulator. "They've done absolutely nothing."

Many key sections of Dodd-Frank, in fact, are now experiencing such "unforeseen" delays. The Volcker Rule, which severely restricts the ability of banks to gamble with taxpayer-insured money, is in the midst of an impressive double delay. Regulators have been so slow to wade through the flood of 17,000 comment letters submitted on the rule, most of them from Wall Street interests, that they may not be finished writing the regulation by the Dodd-Frank-mandated deadline of July 21st, 2012 – two years after the bill passed.

But instead of kicking regulators in the pants, six senators, led by Republican Mike Crapo of Idaho, introduced legislation to give regulators more time to (not) finish writing the law. On April 19th, the Federal Reserve announced that it won't implement the Volcker Rule until 2014 – an extra two years that will give Wall Street plenty of time to find a way to kill the thing for good.

STEP 4: BULLY THE REGULATORS

A seldom-considered factor in Dodd-Frank is that Congress controls the funding for the federal regulators who are charged with carrying out the new law. Last year, after Republicans attempted to slash the CFTC's funding by more than 33 percent, Congress settled for freezing the agency's budget, despite the fact that under Dodd-Frank, the market that the CFTC is responsible for overseeing soared from $40 trillion to $340 trillion. That same year, Republicans tried to cut the SEC's budget by more than $25 million.

This results in a curious dynamic: When Wall Street is frustrated by regulators in the rule-making process, it can simply lobby Congress to rein them in. The regulators are then forced to strategically surrender on the rules in order to stave off budget cuts, Eugene Scalia or whatever other horror-show phenomena Congress and the financial industry might throw their way.

Take those huge Paul Ryan-led budget cuts that the House passed in April, scrapping the entire bailout portion of Dodd-Frank. The cuts may not survive in the Senate, which is still controlled by Democrats. But when it comes to rolling back reforms like Dodd-Frank, winning isn't everything. These continual whippings of the new law in the House serve a larger purpose, which is to frighten and intimidate regulators like the SEC and the CFTC, who aren't even finished writing the law's actual rules. The message is clear: If you don't write the rules in the weakest way possible, we have the juice to overturn you in Congress.

"What this is, above all else, is a play to put the House on record," says one congressional staffer familiar with the budget-cutting battle. "It's a leverage tactic. If they have 75 percent of the Financial Services Committee that says, 'You've made mistakes,' or 'This is too gray,' that is a huge hole card."

Even the CFTC admits this pressure exists: Commissioner Bart Chilton warned in March that his regulators risk being "scared into making rules and regulations that are weak or ineffective because we are overly concerned about what we call 'litigation risk.'" According to Marcus Stanley, policy director for Americans for Financial Reform, one regulator admitted that he worries in advance about Wall Street going over his head. "If we make this rule too tough," the regulator told Stanley, "industry is just going to go to Congress and punch it full of holes."

A prime example of the crack suicide-squad preemptive-surrender strategy practiced by regulators involves the provisions of Dodd-Frank designed to curtail complex derivatives, like swaps, which caused disasters like the crash of AIG and the bankruptcy of Jefferson County, Alabama. Under the law, the SEC and the CFTC must decide which swaps dealers will be governed by new rules, requiring them to maintain more capital and collateral. Originally, the agencies were thinking of regulating any dealer who manages more than $100 million in swaps. But then Rep. Randy Hultgren, a Republican from Illinois, proposed H.R. 3727 – one of the nine GOP-sponsored bills to kill Dodd-Frank – that would raise the threshold to $3 billion in swaps. Overreacting to industry pressure, both the SEC and the CFTC then volunteered to raise the threshold to $8 billion. That means at least two-thirds of all swaps dealers in America will now be exempt from Dodd-Frank. Given the new threshold, consumer advocates calculate, you could make 1,600 swaps transactions a year, each worth $5 million, and still not have to so much as register as a swaps dealer.

The thought provokes something verging on despair in those who have devoted themselves to fighting for real financial reform. "If I didn't have to spend my whole life in this," Stanley says sadly, "it would be funny."

STEP 5: PASS A GAZILLION LOOPHOLES

By the beginning of this year, as a result of all of these threats, delays and lawsuits, Americans could barely see Dodd-Frank's footprint in their everyday economic life. Yet Wall Street was still insufficiently convinced that key portions of Dodd-Frank were really dead. So it went over the heads of regulators and impelled Republicans in the House to create an avalanche of new laws designed to undercut the rules the CFTC and SEC were already heroically failing to write.

You might wonder how a bunch of lunkhead Republican congressmen would even know how to write a coordinated series of "technical fixes" to derivatives regulation, a universe so complicated that it has become hard to find anyone on the Hill who truly understands the subject. (One congressman who sits on the Financial Services Committee laughingly admitted that when the crash of 2008 happened, he had to look up "credit default swaps" on Wikipedia.) It turns out, they had help from the inside. Scott O'Malia, a Republican commissioner on the CFTC who formerly served as an aide to Senate Minority Leader Mitch McConnell, apparently sent a member of his staff over to the House to help the Republicans write bills to undercut the CFTC's authority. Originally a Bush appointee, O'Malia ignited a controversy when he was renominated to the CFTC by Obama because he had once been a lobbyist for Mirant, an energy company that was caught withholding power from California during blackouts. One of Mirant's subsidiaries was even fined $12.5 million for attempting to manipulate natural gas prices.

Now, Obama's own appointee is reportedly leading the charge against finance reform. "O'Malia has assigned a staffer to quarterback all of these bills," says Greenberger. "He's orchestrating a sort of under-cover-of-darkness approach to driving holes in Dodd-Frank."

The nine bills being contemplated by Congress take a variety of approaches to gutting Dodd-Frank. Two bills, H.R. 1840 and H.R. 2308, are essentially stalling tactics, requiring regulators to undertake more of those sweeping cost-benefit analy ses that result in lengthy delays. Another bill, H.R. 3283, is more substantive: Sponsored by Connecticut Democrat and hedge-fund industry BFF Jim Himes, it exempts foreign affiliates of U.S. swaps dealers from all Dodd-Frank oversight. The rule, if implemented, would make the next AIG possible, given that AIG was undone by half a trillion dollars in derivative bets produced by such a foreign affiliate – its London-based financial products outfit, AIGFP. If passed, says Rep. Brad Miller, a Democrat from North Carolina, H.R. 3283 would leave a "massive, gaping hole" in Dodd-Frank. "It would be very easy to move those trades to whatever the most indulgent country would be," Miller explains.

The bill also exempts from oversight any swaps deals between company affiliates – meaning that Goldman Hong Kong can sell swaps to Goldman New York without having to deal with Dodd-Frank. That sounds harmless, but when you combine it with the AIG-style exemption, a bank would basically be able to get around Dodd-Frank entirely by creating its swaps products at an overseas branch, or moving them back and forth between affiliates.

An even more distressing bill, which recently raced through the committee process with a simple voice vote, is H.R. 3336, granting broad exemptions from swaps regulations to any company that offers "extensions of credit" to customers. There are some who are convinced that once the financial industry's lawyers get hold of this "extensions of credit" line, they will use it to win exemptions for banks engaged in almost any kind of lending activity – including those involved with municipal-bond offerings, one of the most dependably corrupt businesses in the American economy.

"If all of these bills pass," says Stanley, "I don't know why we wouldn't just invite the industry lobbyists in to rewrite the rules."

All of these derivatives issues are oppressively dull and technical, and it's extremely difficult for most people to imagine how something like Jim Himes' exemption for foreign affiliates can actually affect their daily lives. But having an unregulated market instead of a regulated one might mean you'll pay an extra 50 cents for every gallon of gas (or possibly more, even according to Goldman Sachs). Or you might have to pay hundreds or thousands more in taxes every year because your town or county or country, if you happen to live in Greece, grossly overpaid an investment bank when it borrowed money. An unregulated derivatives market essentially gives Wall Street a way to place hidden taxes on everything in the world.

The best way to explain where those hidden taxes come from is to compare a regulated market to an unregulated one. It's the difference between buying soap and buying drugs. You go into a corner store and there's a price tag on the soap, but you can always go across the street, or on the Internet, to see what soap costs someplace else. But when you go to buy an eight ball of coke, you have to ask your dealer what the price is, and it's not like you can compare prices online. If you're tough and streetwise and you know what coke costs, you might get it for a couple hundred bucks. But if you're some quivering Ivy Leaguer idling in a Lexus, the price might be $400.

That's how the swaps market works. It operates completely in the dark. If you're some Podunk town in Texas or Alabama and you need swaps financing, you've got to ask Goldman Sachs or Morgan Stanley what it costs. There's no exchange where you can compare prices. And modern investment bankers are ethically a notch below your average drug dealer. They will extract from their customer – a town, an airline, a chain of retail stores – whatever they think he'll pay. And that extra cost will be passed on to you by the overcharged customer, in the form of higher taxes, bigger home-heating bills, higher sewer rates or pricier airline tickets. Wall Street will be taking a bite out of you every time you write a check.

Under normal circumstances, seeing the Republicans send a bunch of evil bills like the derivatives exemption to the Democrat-controlled Senate wouldn't scare reform advocates too much. But in March and April, something happened that sent progressives into a veritable panic – the passage of the so-called JOBS Act, a sweeping, bank-fellating deregulatory law that rolled back a smorgasbord of regulations designed to protect investors from fraud in the IPO markets. The White House, eager to greenlight "crowdfunding" investments and a handful of other sensible reforms contained in the bill, leaned on the Senate leadership to send the measure straight to the floor for a vote. That meant this monster deregulatory bill went directly into the books with minimal testimony, no committee hearings and no real debate of any kind.

Now, in the wake of the JOBS Act fiasco, many reform advocates expect the same scenario to repeat itself with the nine bills to roll back Dodd-Frank. In the House, a number of the most dangerous derivatives bills have been passed by "suspension," a simplified voice-voting process usually reserved for uncontroversial items. The truly sinister thing is that, in order for a bill to be put on the suspension calendar, the two parties must agree – meaning that Democrats signed off on this Trojan-horse method of treating complex, economy-altering bills as minor technical "fixes."

The truth is that Dodd-Frank is so huge, and contains so many complicated new rules, that there are, in fact, many areas where small technical fixes are needed. H.R. 4235, one of the nine bills brought before Congress, resolves a real problem with the way swaps data is collected, an issue that was preventing foreign swaps dealers from getting onboard with the reform. But when needed fixes like this are thrown in side by side with a mind-boggling exemption for swaps dealers like H.R. 3336, which hits the floor as the innocuously named "Small Business Credit Availability Act," all those members of Congress who don't sit on the Financial Services Committee will have no way of telling which bill is the minor technical fix and which is the sweeping repeal. Moreover, when those members see that some bills are co-sponsored by Democrats, and that the Democratic leadership agreed to put the bills on the suspension calendar for a simple voice vote, many will take it as a cue that it's OK to vote for the rollbacks.

That's particularly true because most members of Congress know that the public seldom pays any attention to the fiendish complexities of things like derivatives reform. "I've never had someone back in the district say to me, 'I think derivatives need to be traded on an exchange,'" says Miller. "These are the kinds of issues that aren't going to have any pop in a 30-second ad."

The nine bills to gut Dodd-Frank could also receive a JOBS Act-style welcome when they reach the Senate. There are only two Senate committees with the jurisdiction to tackle these bills, and neither appears to be planning to take a whack at any of the new measures. The Agriculture Committee, which oversees the CFTC, has been busy dealing with a huge farm bill. The Banking Committee, which oversees the SEC, is dominated by Democrats who wouldn't mind at all if Dodd-Frank had both its legs broken, including Chuck Schumer of New York and Mark Warner of Virginia. What's more, the committee's understated chairman, Sen. Tim Johnson of South Dakota, seems weirdly willing to let pretty much anything touching the financial world roll straight to a vote without his changing a comma – a sharp contrast to the days when fist-shaking politcal Godhead Chris Dodd ran the committee.

"Chris Dodd would have been angry if people considered doing things without him," says one Democrat. "He'd be like, 'You, out of my sandbox.'"

That means all those thousands of hours of debate and fierce negotiation spent hammering out Dodd-Frank two years ago might now go up in smoke in a matter of a few quiet minutes. Of the big-ticket items that were actually passed two years ago, the derivatives reforms have been completely gutted by loopholes, the Volcker Rule has been delayed for two years, and the Consumer Financial Protection Bureau may be thrust under the budgetary control of Congress, which is determined to destroy it. And much of this is taking place with the assent of Democrats, for a very simple reason: because the name of the game isn't cleaning up Wall Street, it's cleaning out Wall Street – throwing a "yes" vote at a bank-approved bill to get them to pony up in an election year. "All this is aimed at the financial services industry," admits one senior Democratic congressional aide. "It's to let them know, 'Hey, you're OK, we're not going to destroy your business – and give us your money, because we're trying to raise it for an election.'"

That's the underlying problem with cracking down on Wall Street: Our political-economic system has grown too knotted and unmanageable for democratic rule. While it's incredibly difficult to get a regulatory reform passed, it's far easier – and more profitable to politicians – to kill it. Creating legislation is a tough process. But watering down legislation? Strangling it with lawsuits and comment letters and blue-ribbon committees? Not so tough, it turns out.

You can't buy votes in a democracy, at least not directly, but our democracy is run through a bureaucracy. Human beings can cast a vote, or rally together during protests and elections, but real people – even committed professionals – get tired of running through mazes of motions and countermotions, or reading thousands of pages about swaps-execution facilities and NRSROs. They will fight through it for five days, or maybe even six, but on the seventh they will watch a baseball game, or Tanked, instead of diving into that morass of hellish acronyms one more time.

But money never gets tired. It never gets frustrated. And it thinks that drilling holes in Dodd-Frank is every bit as interesting as The Book of Mormon or Kate Upton naked. The system has become too complex for flesh-and-blood people, who make the mistake of thinking that passing a new law means the end of the discussion, when it's really just the beginning of a war.

This story is from the May 24th, 2012 issue of Rolling Stone.

Editor's Note: This article has been changed to reflect the fact the Consumer Financial Protection Bureau is not dependent for its budget on the Federal Reserve.

Matt Taibbi is a contributing editor for Rolling Stone. He’s the author of five books, most recently The Great Derangement and Griftopia, and a winner of the National Magazine Award for commentary.

All,

The biggest and by far the most important and relevant story in all of American politics (and economics) today. The massive tragedy is that relatively few people are even paying any attention at all given the ongoing sideshow spectacle of the upcoming presidential elections whose outcome will--as always--be ruthlessly controlled and criminally directed by the super wealthy elites represented by the banks, corporations, and other Wall Street financial institutions no matter who "wins" the election. As usual the brilliant political journalist and economic analyst Matt Taibbi does a masterful and very revealing job of telling us exactly how and why this is so and what it really means...

Kofi

"The fate of Dodd-Frank over the past two years is an object lesson in the government's inability to institute even the simplest and most obvious reforms, especially if those reforms happen to clash with powerful financial interests. From the moment it was signed into law, lobbyists and lawyers have fought regulators over every line in the rulemaking process. Congressmen and presidents may be able to get a law passed once in a while – but they can no longer make sure it stays passed. You win the modern financial-regulation game by filing the most motions, attending the most hearings, giving the most money to the most politicians and, above all, by keeping at it, day after day, year after fiscal year, until stealing is legal again. "It's like a scorched-earth policy," says Michael Greenberger, a former regulator who was heavily involved with the drafting of Dodd-Frank. "It requires constant combat. And it never, ever ends." That the banks have just about succeeded in strangling Dodd-Frank is probably not news to most Americans – it's how they succeeded that's the scary part. The banks followed a five-point strategy that offers a dependable blueprint for defeating any regulation – and for guaranteeing that when it comes to the economy, might will always equal right."--Matt Taibbi

How Wall Street Killed Financial Reform

It's bad enough that the banks strangled the Dodd-Frank law. Even worse is the way they did it - with a big assist from Congress and the White House.

by Matt Taibbi

May 10, 2012

Rolling Stone

Two years ago, when he signed the Dodd-Frank Wall Street Reform and Consumer Protection Act, President Barack Obama bragged that he'd dealt a crushing blow to the extravagant financial corruption that had caused the global economic crash in 2008. "These reforms represent the strongest consumer financial protections in history," the president told an adoring crowd in downtown D.C. on July 21st, 2010. "In history."

This was supposed to be the big one. At 2,300 pages, the new law ostensibly rewrote the rules for Wall Street. It was going to put an end to predatory lending in the mortgage markets, crack down on hidden fees and penalties in credit contracts, and create a powerful new Consumer Financial Protection Bureau to safeguard ordinary consumers. Big banks would be banned from gambling with taxpayer money, and a new set of rules would limit speculators from making the kind of crazy-ass bets that cause wild spikes in the price of food and energy. There would be no more AIGs, and the world would never again face a financial apocalypse when a bank like Lehman Brothers went bankrupt.

Most importantly, even if any of that fiendish crap ever did happen again, Dodd-Frank guaranteed we wouldn't be expected to pay for it. "The American people will never again be asked to foot the bill for Wall Street's mistakes," Obama promised. "There will be no more taxpayer-funded bailouts. Period."

Two years later, Dodd-Frank is groaning on its deathbed. The giant reform bill turned out to be like the fish reeled in by Hemingway's Old Man – no sooner caught than set upon by sharks that strip it to nothing long before it ever reaches the shore. In a furious below-the-radar effort at gutting the law – roundly despised by Washington's Wall Street paymasters – a troop of water-carrying Eric Cantor Republicans are speeding nine separate bills through the House, all designed to roll back the few genuinely toothy portions left in Dodd-Frank. With the Quislingian covert assistance of Democrats, both in Congress and in the White House, those bills could pass through the House and the Senate with little or no debate, with simple floor votes – by a process usually reserved for things like the renaming of post offices or a nonbinding resolution celebrating Amelia Earhart's birthday.

The fate of Dodd-Frank over the past two years is an object lesson in the government's inability to institute even the simplest and most obvious reforms, especially if those reforms happen to clash with powerful financial interests. From the moment it was signed into law, lobbyists and lawyers have fought regulators over every line in the rulemaking process. Congressmen and presidents may be able to get a law passed once in a while – but they can no longer make sure it stays passed. You win the modern financial-regulation game by filing the most motions, attending the most hearings, giving the most money to the most politicians and, above all, by keeping at it, day after day, year after fiscal year, until stealing is legal again. "It's like a scorched-earth policy," says Michael Greenberger, a former regulator who was heavily involved with the drafting of Dodd-Frank. "It requires constant combat. And it never, ever ends."

That the banks have just about succeeded in strangling Dodd-Frank is probably not news to most Americans – it's how they succeeded that's the scary part. The banks followed a five-point strategy that offers a dependable blueprint for defeating any regulation – and for guaranteeing that when it comes to the economy, might will always equal right.

STEP 1: STRANGLE IT IN THE WOMB

The first advantage the banks had lay in the fact that for all Obama's bluster, Dodd-Frank was never such a badass law to begin with. In fact, Obama's initial response to the devastating financial events of 2008 represented a major departure from the historical precedent his own party had set during the 1930s, when President Franklin D. Roosevelt launched an audacious rewrite of the rules governing the American economy following the Great Crash of 1929.

Upon entering office, FDR was in exactly the same position Obama found himself in after his inauguration in 2009. Then, as now, the American economy was in tatters after the bursting of a massive financial bubble, brought on when speculators borrowed huge sums and gambled on unregistered securities in largely unregulated exchanges. This mania for instant riches led to an explosion of Wall Street fraud and manipulation, creating a mountain of illusory growth divorced from the real-world economy: Of the $50 billion in securities sold in America in the 1920s, half turned out to be worthless.

Roosevelt's response to all of this was to pass a number of sweeping new laws that focused on a single theme: protecting consumers by forcing the business of Wall Street into the light. The Securities Act of 1933 required all publicly traded companies to register themselves and offer prospectuses to investors; the Securities Exchange Act of 1934 forced publicly traded companies to make regular financial disclosures; and the Commodity Exchange Act of 1936 required all commodities and futures to be traded on organized exchanges. FDR also created the FDIC to protect bank depositors (through an insurance fund paid for by the banks themselves) and passed the Glass-Steagall Act to separate insurance companies, investment banks and commercial banks. Post-New Deal, if you put money in a bank, you knew it was safe, and if you bought stock, you knew what you were buying.

This reform strategy worked for more than half a century – and it offered Obama a clear outline of how to respond to the crash he faced. What made 2008 possible was that Wall Street had moved its speculative frenzy away from the regulated exchange system created by FDR, and into darker, less-regulated markets that had coalesced around brand-new financial innovations like credit default swaps and collateralized-debt obligations. It wasn't that the old system had broken down; Wall Street had just moved the playground.

All Obama needed to do to rescue the economy and protect consumers was to make sure that the new playground had some rules. That meant moving swaps and other derivatives onto open exchanges, making sure that federally insured banks that dabbled in those dangerous markets retained more capital, and coming up with some kind of plan to prevent the next AIG or Lehman Brothers disaster – i.e., a plan for unwinding failing companies that wouldn't require federal bailouts.

The initial proposal for Dodd-Frank addressed most of those concerns. As drafted, it would have created a system for shutting down failing megafirms, required swaps to be traded and cleared on regulated exchanges, and restored the spirit of Glass-Steagall through the so-called Volcker Rule, which would have prevented federally insured banks from engaging in dangerous speculation. It envisioned a powerful new Consumer Financial Protection Bureau to represent the interests of consumers against Wall Street, a bureau headed not by some banker stooge but by an actual consumer advocate and financial expert like Elizabeth Warren, the Harvard professor who came up with the idea. And it would have cleaned up the mortgage markets by ending predatory home-lending and forcing everyone in the market, from homeowners to banks to investors buying mortgage securities, to post real cash and keep "skin in the game" when buying or selling a mortgage.

Then, behind the closed doors of Congress, Wall Street lobbyists and their allies got to work. Though many of the new regulatory concepts survived in the final bill, most of them wound up whittled down to such an extreme degree that they were barely recognizable in the end. Over the course of a ferocious year of negotiations in the House and the Senate, the rules on swaps were riddled with loopholes: One initially promising rule preventing federally insured banks from trading in risky derivatives ultimately ended up exempting a huge chunk of the swaps market from the new law. The Volcker Rule banning proprietary gambling survived, but not before getting its brains beaten out in last-minute conference negotiations; Wall Street first won broad exemptions for mutual funds, insurers and trusts, and then, with the aid of both Treasury Secretary Tim Geithner and Sen. Chuck Schumer of New York, managed to secure a lunatic and arbitrary numerical exemption that allows banks to gamble up to three percent of their "Tier 1" capital, a number that for big banks stretches to the billions.

Then there was the Consumer Financial Protection Bureau, which went from being a powerful, independent agency run by Elizabeth Warren to a smaller bureau within the Federal Reserve System run by - well, anyone but Elizabeth Warren. With Geithner and Republicans in Congress blocking her once-inevitable appointment, we no longer had Warren playing watchdog to Federal Reserve chief Ben Bernanke - instead we had new CFPB head Richard Cordray, a former Ohio attorney general who enjoys far less of a popular mandate than Warren, forced to operate within the bureaucracy of Bernanke's Fed.

But the best example of how the watering-down process helped make Dodd-Frank ripe for a later killing was the question of Too Big to Fail. Obama, Geithner and the Democratic leadership in Congress never seriously entertained enacting the most obvious and necessary reform at all – breaking up the so-called "systemically important financial institutions" (the congressional term for "banks so huge we'll have to bail them out if they collapse"). Rather than simply stopping these firms from getting so big that they'd blow up the universe in a collapse, the Democrats opted for a half-clever semantic trick, claiming they had solved the future bailout question with Title II of the Dodd-Frank Act, known as the "Orderly Liquidation Authority" or "OLA" section of the bill.

In a nod to FDR, Title II would have forced major financial companies to pay $19 billion into an FDIC-style fund that would cover the cost of any future bailouts. But then the balance of power in the Senate was upset by the election of Republican Scott Brown to Ted Kennedy's seat in Massachusetts. As the clock wound down toward the bill's passage, Brown insisted on a change: Instead of making ginormous companies pay $19 billion in advance, the FDIC would first use taxpayer money to pay for any bailouts, and then spend years trying to recover that money from Wall Street by means of an assessment process so convoluted that you could grow a four-foot beard in the time it would take to understand it. Republicans managed to wrangle support, in conference, for the "bailout now, pay later" idea, and it made its way into the final bill.

Fast-forward to 2012. Rep. Paul Ryan, the self-styled Edward Scissorhands of Republican budget slashing, gathers the GOP leadership together and tells the chairman of each committee that he wants them, collectively, to come up with $261 billion in cuts. Ryan demands $35 billion of the cuts come from the Financial Services Committee, which oversees much of the regulatory apparatus that would enforce Dodd-Frank. The committee is now chaired not by the reform bill's namesake, Rep. Barney Frank, but by median-intellected Spencer Bachus of Alabama, who last year voted to delay Dodd-Frank reforms designed to prevent swaps disasters like the one that drove his home turf of Jefferson County into bankruptcy.

Bachus' solution to coming up with massive budget cuts? Eliminate the entire Title II section of Dodd-Frank. If another bank failed, Bachus argued, it would take way too long to recoup the bailout money from Wall Street through that crazy assessment process that Republicans themselves had insisted on only two years earlier. In the end, the logic went, taxpayers would wind up footing the bill anyway, so better just to scrap the entire plan to have the FDIC pay for the bailouts upfront – thus "saving" taxpayers some $22 billion.

The logic, of course, is complete nonsense. Without Title II, we'd be right back where we started – rushing to implement an expensive bailout in the midst of a crisis, without any way to make Wall Street repay the money. But because Democrats had preemptively surrendered on the original idea of forcing Wall Street to pay into an FDIC-style kitty ahead of time, Republicans were now in a position to push the whole bailout plan off the pier via a simple budget resolution.

To make up the rest of the $35 billion in budget cuts ordered by Paul Ryan, Bachus also proposed slashing Obama's mortgage-aid program and making the Consumer Financial Protection Bureau subordinate to a congressional appropriations process – meaning that its budget could be subjected to never-ending attacks by the GOP. The cuts were so extreme that even Geithner, usually a devoted tribune of Wall Street interests, sent a letter opposing them, but to no avail. The budget-slashing resolution passed the House this April.

The problem with attacking laws in Congress, of course, is that you need to control both chambers to make it stick. The Bachus-budget gambit may not have much of a chance of passing in the Senate, which is still controlled by the Democrats, but that won't faze opponents of Dodd-Frank, who have found an even more dependable arena for gutting the new law:

STEP 2: SUE, SUE, SUE

While death and taxes may be only relative certainties in today's economy – failing megabanks neither die nor pay taxes anymore – one thing that was always absolutely certain from the start was that Wall Street was going to sue the living hell out of Washington before the ink was even dry on Dodd-Frank. It took a little while, but the banks very quickly found a tried-and-true method of tying up the reforms in court.

Wall Street's first big win involved a small-but-important change known as the "proxy access" rule, which made it easier for people who own stakes in a company to remove directors from the board – giving shareholders more power to rein in corrupt or overpaid company executives. More democracy in business sounded like a good idea to almost everyone. But Wall Street has a dependable playbook for getting rid of any reform, no matter how small, that leads to greater accountability. "First, they hire a shit-ton of lobbyists to go to the regulators," says Jim Collura, spokesman for the Commodity Markets Oversight Coalition. "Then, they beat the crap out of them during the rulemaking process. And then, when that's over, they litigate the hell out of them."

Sue their asses! For all the right's supposed hatred of "activist judges," conservatives immediately flocked to the courts in search of magistrates willing to casually overturn the work of elected officials. In the case of the proxy access rule, Wall Street convinced its two favorite lobbying arms, the Business Roundtable and the Chamber of Commerce, to sue the Securities Exchange Commission over a technicality, claiming that the agency had not done a proper cost-benefit analysis before it instituted the new rule. In an appropriately loathsome touch, the Chamber's legal team was led by one Eugene Scalia, son of Supreme Court Justice Antonin Scalia. The younger Scalia, who looks like the product of a twisted test-tube experiment that crossed his father with Ari Fleischer, pitched a federal appeals court on the idea that the proxy access rule was "arbitrary and capricious," and that the SEC hadn't spent enough time studying the rule's effects on "efficiency, competition and capital formation."

In fact, the agency had produced 60 pages of cost-benefit analysis and had spent, according to SEC chief Mary Schapiro, some 21,000 man-hours working on the bill and studying its effects. Still, the court wasn't impressed. In his opinion, presiding judge and Reagan appointee Douglas Ginsburg peed all over Dodd-Frank, vacating the rule, which he dismissed as "unutterably mindless." With striking chutzpah, considering that he was ruling in a case brought by the mother of all special interest lobbies, Ginsburg also denounced the shareholder rule as a gift to special interests, particularly "unions and government pension funds."

Almost immediately after the win, the gloating Scalia issued a thinly veiled threat to regulators, letting them know that any attempt to implement more limits on Wall Street would likely result in the same kind of lawsuit. "I would hope the agencies are taking to heart the potential consequences for Dodd-Frank rules," he chirped.

The success of the lawsuit cemented Wall Street's strategy for doing away with Dodd-Frank. Rather than challenge the constitutionality of the bill in one broad suit, the finance industry would take the bill apart by pulling out one fingernail at a time. "Dodd-Frank is not one thing but many," Margaret Tahyar, a partner at the white-shoe corporate defense firm Davis Polk, told reporters last year. "There is no reasonable constitutional or statutory challenge on the whole – only on the bits and pieces."

Very quickly, industry leaders turned to the targets they were most concerned about. This time, two bank-friendly industry groups sued the Commodity Futures Trading Commission (CFTC) to stop it from implementing "position limits" in the derivatives market. Unlike the proxy access rule, which was essentially a procedural issue, position limits got right to the heart of a monstrous international problem – the perversion of fuel and food prices by financial speculators. The oil bubble of 2008, in which a barrel of oil rose to a preposterous $146 before falling to an equally preposterous $35, was one result of such wanton speculation; the surge in global food prices that led to the Middle East revolutions last year was another.

The position limits set by Dodd-Frank were designed to prevent any one speculator from controlling more than 25 percent of a commodities market at any given moment. To say that this is an issue that shouldn't be litigated over a technicality is an understatement; it's not a stretch to say that the viability of capitalism itself is at least partially at stake here. The rule, after all, would help ensure that prices are pegged to the real supply and demand of real producers and consumers, not to fantasy bets placed by market-monopolizing speculators. But the industry sued the CFTC over the exact same issue – the supposed lack of sufficient cost-benefit analysis – that the Chamber of Commerce used to derail the proxy access rule. And once again, the industry hired the ass-kicking Scalia, who argued that the CFTC had failed to provide "sufficient evidence" for its decision to establish position limits.

In an even more awesome demonstration of sheer balls, Scalia & Co. also argued that the CFTC's vote to establish position limits was invalid because one of the agency's commissioners, Michael Dunn, did not really believe in the law. Dunn had quit the CFTC to take a cushy job at a Wall Street-friendly law firm, and on the way out the door, he whined that he had only voted for position limits because Dodd-Frank forced him to, calling the rule a "cure for a disease that does not exist." So under the novel test offered by Scalia, rules like position limits – approved by Congress after months of debate – could be invalidated simply because a federal commissioner who signed off on the details wasn't emotionally on board at the moment of the rule's conception.

The lawsuit by Scalia & Co. succeeded in gumming up the works. The industry has tried to get the court to issue an immediate stay on the implementation of position limits, and the case is likely to drag on for months. Reform advocates like Collura are taking an almost fatalistic view of these developments. "Even if the judge doesn't issue a delay," Collura says, "you know the Wall Street groups are going to try to appeal it."

STEP 3: IF YOU CAN'T WIN, STALL

You might think otherwise, but it doesn't naturally follow that because a law has been passed by Congress and signed by the president, said law actually has to be implemented. With Dodd-Frank, the SEC took a brilliant approach to submarining one of its own regulations. The agency was supposed to begin enforcing the new proxy access rule by late 2010. Instead, in October 2010, it granted speculators a last-minute stay – essentially giving the Chamber of Commerce time to prepare its lawsuit to permanently kill the rule.

Position limits are another example. Dodd-Frank ordered the CFTC to begin enforcing the new rule no later than January 17th, 2011. But January 17th came and went, and – no position limits! Gary Gensler, the head of the CFTC and a former executive of Goldman Sachs, then announced that he hoped to implement the rule by September 2011. But September came and went, and soon it was 2012, and before you knew it, the CFTC, like the SEC, was in court, facing a lawsuit that would permanently kill the rule.

Even the president got into the stalling game. During the year of nonaction on position limits, the "disease that did not exist" – energy speculation – returned to ravage the American gasoline market. In the winter of 2011, oil soared above $100 a barrel, despite fundamentals of supply and demand that would have suggested a price drop. Obama blasted fuel speculators for the price hike and announced that he was creating the Oil and Gas Price Fraud Working Group to "root out any cases of fraud or manipulation in the oil markets." He added, in stern and stirring tones, "We're going to make sure that nobody is taking advantage of American consumers for their own short-term gain."

This was a curious decision. If Obama really wanted to stop speculation in the oil markets, he didn't need to create a brand-new task force that would have to start from scratch to deal with a hellishly complex problem that Congress and the CFTC had already spent years studying. "An easier way to deal with excessive oil speculation," one senior Senate aide explains, "is for the president to just pick up the phone, call Gary Gensler and say, 'The Dodd-Frank Act required you to put in strong position limits by January 17th, 2011. Get off your butt and act.'"

The Oil and Gas Working Group turned out to be a complete sham. In its year of ostensible existence, the panel met only a few times, then never bothered to convene again. One source on the Hill tells me that some of the members were not even aware that they'd been named to the task force for months. It was such a Potemkin committee that when oil prices once again shot up past $100 a barrel this year, Obama was hilariously forced to announce that he was "reconstituting" the task force, even though it had never officially disbanded. "It's a joke," says Greenberger, the former regulator. "They've done absolutely nothing."

Many key sections of Dodd-Frank, in fact, are now experiencing such "unforeseen" delays. The Volcker Rule, which severely restricts the ability of banks to gamble with taxpayer-insured money, is in the midst of an impressive double delay. Regulators have been so slow to wade through the flood of 17,000 comment letters submitted on the rule, most of them from Wall Street interests, that they may not be finished writing the regulation by the Dodd-Frank-mandated deadline of July 21st, 2012 – two years after the bill passed.

But instead of kicking regulators in the pants, six senators, led by Republican Mike Crapo of Idaho, introduced legislation to give regulators more time to (not) finish writing the law. On April 19th, the Federal Reserve announced that it won't implement the Volcker Rule until 2014 – an extra two years that will give Wall Street plenty of time to find a way to kill the thing for good.

STEP 4: BULLY THE REGULATORS

A seldom-considered factor in Dodd-Frank is that Congress controls the funding for the federal regulators who are charged with carrying out the new law. Last year, after Republicans attempted to slash the CFTC's funding by more than 33 percent, Congress settled for freezing the agency's budget, despite the fact that under Dodd-Frank, the market that the CFTC is responsible for overseeing soared from $40 trillion to $340 trillion. That same year, Republicans tried to cut the SEC's budget by more than $25 million.

This results in a curious dynamic: When Wall Street is frustrated by regulators in the rule-making process, it can simply lobby Congress to rein them in. The regulators are then forced to strategically surrender on the rules in order to stave off budget cuts, Eugene Scalia or whatever other horror-show phenomena Congress and the financial industry might throw their way.

Take those huge Paul Ryan-led budget cuts that the House passed in April, scrapping the entire bailout portion of Dodd-Frank. The cuts may not survive in the Senate, which is still controlled by Democrats. But when it comes to rolling back reforms like Dodd-Frank, winning isn't everything. These continual whippings of the new law in the House serve a larger purpose, which is to frighten and intimidate regulators like the SEC and the CFTC, who aren't even finished writing the law's actual rules. The message is clear: If you don't write the rules in the weakest way possible, we have the juice to overturn you in Congress.

"What this is, above all else, is a play to put the House on record," says one congressional staffer familiar with the budget-cutting battle. "It's a leverage tactic. If they have 75 percent of the Financial Services Committee that says, 'You've made mistakes,' or 'This is too gray,' that is a huge hole card."

Even the CFTC admits this pressure exists: Commissioner Bart Chilton warned in March that his regulators risk being "scared into making rules and regulations that are weak or ineffective because we are overly concerned about what we call 'litigation risk.'" According to Marcus Stanley, policy director for Americans for Financial Reform, one regulator admitted that he worries in advance about Wall Street going over his head. "If we make this rule too tough," the regulator told Stanley, "industry is just going to go to Congress and punch it full of holes."

A prime example of the crack suicide-squad preemptive-surrender strategy practiced by regulators involves the provisions of Dodd-Frank designed to curtail complex derivatives, like swaps, which caused disasters like the crash of AIG and the bankruptcy of Jefferson County, Alabama. Under the law, the SEC and the CFTC must decide which swaps dealers will be governed by new rules, requiring them to maintain more capital and collateral. Originally, the agencies were thinking of regulating any dealer who manages more than $100 million in swaps. But then Rep. Randy Hultgren, a Republican from Illinois, proposed H.R. 3727 – one of the nine GOP-sponsored bills to kill Dodd-Frank – that would raise the threshold to $3 billion in swaps. Overreacting to industry pressure, both the SEC and the CFTC then volunteered to raise the threshold to $8 billion. That means at least two-thirds of all swaps dealers in America will now be exempt from Dodd-Frank. Given the new threshold, consumer advocates calculate, you could make 1,600 swaps transactions a year, each worth $5 million, and still not have to so much as register as a swaps dealer.

The thought provokes something verging on despair in those who have devoted themselves to fighting for real financial reform. "If I didn't have to spend my whole life in this," Stanley says sadly, "it would be funny."

STEP 5: PASS A GAZILLION LOOPHOLES

By the beginning of this year, as a result of all of these threats, delays and lawsuits, Americans could barely see Dodd-Frank's footprint in their everyday economic life. Yet Wall Street was still insufficiently convinced that key portions of Dodd-Frank were really dead. So it went over the heads of regulators and impelled Republicans in the House to create an avalanche of new laws designed to undercut the rules the CFTC and SEC were already heroically failing to write.

You might wonder how a bunch of lunkhead Republican congressmen would even know how to write a coordinated series of "technical fixes" to derivatives regulation, a universe so complicated that it has become hard to find anyone on the Hill who truly understands the subject. (One congressman who sits on the Financial Services Committee laughingly admitted that when the crash of 2008 happened, he had to look up "credit default swaps" on Wikipedia.) It turns out, they had help from the inside. Scott O'Malia, a Republican commissioner on the CFTC who formerly served as an aide to Senate Minority Leader Mitch McConnell, apparently sent a member of his staff over to the House to help the Republicans write bills to undercut the CFTC's authority. Originally a Bush appointee, O'Malia ignited a controversy when he was renominated to the CFTC by Obama because he had once been a lobbyist for Mirant, an energy company that was caught withholding power from California during blackouts. One of Mirant's subsidiaries was even fined $12.5 million for attempting to manipulate natural gas prices.

Now, Obama's own appointee is reportedly leading the charge against finance reform. "O'Malia has assigned a staffer to quarterback all of these bills," says Greenberger. "He's orchestrating a sort of under-cover-of-darkness approach to driving holes in Dodd-Frank."

The nine bills being contemplated by Congress take a variety of approaches to gutting Dodd-Frank. Two bills, H.R. 1840 and H.R. 2308, are essentially stalling tactics, requiring regulators to undertake more of those sweeping cost-benefit analy ses that result in lengthy delays. Another bill, H.R. 3283, is more substantive: Sponsored by Connecticut Democrat and hedge-fund industry BFF Jim Himes, it exempts foreign affiliates of U.S. swaps dealers from all Dodd-Frank oversight. The rule, if implemented, would make the next AIG possible, given that AIG was undone by half a trillion dollars in derivative bets produced by such a foreign affiliate – its London-based financial products outfit, AIGFP. If passed, says Rep. Brad Miller, a Democrat from North Carolina, H.R. 3283 would leave a "massive, gaping hole" in Dodd-Frank. "It would be very easy to move those trades to whatever the most indulgent country would be," Miller explains.

The bill also exempts from oversight any swaps deals between company affiliates – meaning that Goldman Hong Kong can sell swaps to Goldman New York without having to deal with Dodd-Frank. That sounds harmless, but when you combine it with the AIG-style exemption, a bank would basically be able to get around Dodd-Frank entirely by creating its swaps products at an overseas branch, or moving them back and forth between affiliates.

An even more distressing bill, which recently raced through the committee process with a simple voice vote, is H.R. 3336, granting broad exemptions from swaps regulations to any company that offers "extensions of credit" to customers. There are some who are convinced that once the financial industry's lawyers get hold of this "extensions of credit" line, they will use it to win exemptions for banks engaged in almost any kind of lending activity – including those involved with municipal-bond offerings, one of the most dependably corrupt businesses in the American economy.

"If all of these bills pass," says Stanley, "I don't know why we wouldn't just invite the industry lobbyists in to rewrite the rules."

All of these derivatives issues are oppressively dull and technical, and it's extremely difficult for most people to imagine how something like Jim Himes' exemption for foreign affiliates can actually affect their daily lives. But having an unregulated market instead of a regulated one might mean you'll pay an extra 50 cents for every gallon of gas (or possibly more, even according to Goldman Sachs). Or you might have to pay hundreds or thousands more in taxes every year because your town or county or country, if you happen to live in Greece, grossly overpaid an investment bank when it borrowed money. An unregulated derivatives market essentially gives Wall Street a way to place hidden taxes on everything in the world.

The best way to explain where those hidden taxes come from is to compare a regulated market to an unregulated one. It's the difference between buying soap and buying drugs. You go into a corner store and there's a price tag on the soap, but you can always go across the street, or on the Internet, to see what soap costs someplace else. But when you go to buy an eight ball of coke, you have to ask your dealer what the price is, and it's not like you can compare prices online. If you're tough and streetwise and you know what coke costs, you might get it for a couple hundred bucks. But if you're some quivering Ivy Leaguer idling in a Lexus, the price might be $400.

That's how the swaps market works. It operates completely in the dark. If you're some Podunk town in Texas or Alabama and you need swaps financing, you've got to ask Goldman Sachs or Morgan Stanley what it costs. There's no exchange where you can compare prices. And modern investment bankers are ethically a notch below your average drug dealer. They will extract from their customer – a town, an airline, a chain of retail stores – whatever they think he'll pay. And that extra cost will be passed on to you by the overcharged customer, in the form of higher taxes, bigger home-heating bills, higher sewer rates or pricier airline tickets. Wall Street will be taking a bite out of you every time you write a check.

Under normal circumstances, seeing the Republicans send a bunch of evil bills like the derivatives exemption to the Democrat-controlled Senate wouldn't scare reform advocates too much. But in March and April, something happened that sent progressives into a veritable panic – the passage of the so-called JOBS Act, a sweeping, bank-fellating deregulatory law that rolled back a smorgasbord of regulations designed to protect investors from fraud in the IPO markets. The White House, eager to greenlight "crowdfunding" investments and a handful of other sensible reforms contained in the bill, leaned on the Senate leadership to send the measure straight to the floor for a vote. That meant this monster deregulatory bill went directly into the books with minimal testimony, no committee hearings and no real debate of any kind.

Now, in the wake of the JOBS Act fiasco, many reform advocates expect the same scenario to repeat itself with the nine bills to roll back Dodd-Frank. In the House, a number of the most dangerous derivatives bills have been passed by "suspension," a simplified voice-voting process usually reserved for uncontroversial items. The truly sinister thing is that, in order for a bill to be put on the suspension calendar, the two parties must agree – meaning that Democrats signed off on this Trojan-horse method of treating complex, economy-altering bills as minor technical "fixes."