http://www.nytimes.com/2012/12/10/opinion/krugman-robots-and-robber-barons.html?_r=0

All,

In a sordid and nihilistic media age where rampant intellectual and political dishonesty, careerist pandering, and brazen forms of Machiavellian opportunism, rhetorical posturing and public manipulation are almost de rigueur among many "mainstream" journalists it is more than merely inspiring to read the work of writers and thinkers like Paul Krugman whose genuine insight and deep critical consciousness --like that of such equally compelling and committed truth telling contemporary colleagues as Frank Rich, Matt Taibbi, Jeffrey Scahill, Ta-Nehisi Coates, and Jonathan Chait-- is under present circumstances almost downright heroic. In any event Krugman is never afraid to lucidly remind us of exactly what the real consequences of actual public policy are or to tell us how and why political and economic elites in the government, the corporate and financial worlds, and media itself work overtime to openly distort reality and con us into thinking that the endless lies and corny "narratives" they keep spoon feeding the public are the only possible solutions and/or alternatives available to us. Krugman knows far better than that and never fails to say as much. We had all better listen very closely to what he tells us because it's not only true but the quality of our very lives in this society depends on us seriously addressing both the text and subtext of what he's talking about and why...

Kofi

All,

In a sordid and nihilistic media age where rampant intellectual and political dishonesty, careerist pandering, and brazen forms of Machiavellian opportunism, rhetorical posturing and public manipulation are almost de rigueur among many "mainstream" journalists it is more than merely inspiring to read the work of writers and thinkers like Paul Krugman whose genuine insight and deep critical consciousness --like that of such equally compelling and committed truth telling contemporary colleagues as Frank Rich, Matt Taibbi, Jeffrey Scahill, Ta-Nehisi Coates, and Jonathan Chait-- is under present circumstances almost downright heroic. In any event Krugman is never afraid to lucidly remind us of exactly what the real consequences of actual public policy are or to tell us how and why political and economic elites in the government, the corporate and financial worlds, and media itself work overtime to openly distort reality and con us into thinking that the endless lies and corny "narratives" they keep spoon feeding the public are the only possible solutions and/or alternatives available to us. Krugman knows far better than that and never fails to say as much. We had all better listen very closely to what he tells us because it's not only true but the quality of our very lives in this society depends on us seriously addressing both the text and subtext of what he's talking about and why...

Kofi

Robots and Robber Barons

By PAUL KRUGMAN

December 9, 2012

New York Times

The American economy is still, by most measures, deeply depressed. But corporate profits are at a record high. How is that possible? It’s simple: profits have surged as a share of national income, while wages and other labor compensation are down. The pie isn’t growing the way it should — but capital is doing fine by grabbing an ever-larger slice, at labor’s expense.

December 9, 2012

New York Times

The American economy is still, by most measures, deeply depressed. But corporate profits are at a record high. How is that possible? It’s simple: profits have surged as a share of national income, while wages and other labor compensation are down. The pie isn’t growing the way it should — but capital is doing fine by grabbing an ever-larger slice, at labor’s expense.

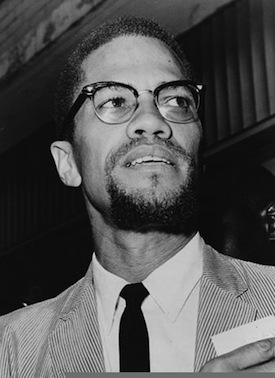

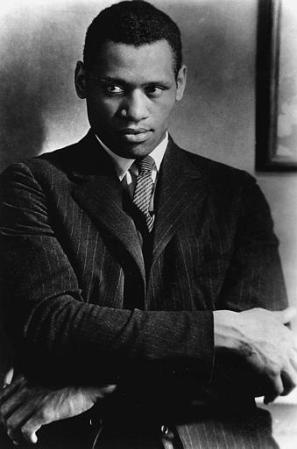

Fred R. Conrad/The New York Times

Paul Krugman

Paul Krugman

Wait — are we really back to talking about capital versus labor? Isn’t that an old-fashioned, almost Marxist sort of discussion, out of date in our modern information economy? Well, that’s what many people thought; for the past generation discussions of inequality have focused overwhelmingly not on capital versus labor but on distributional issues between workers, either on the gap between more- and less-educated workers or on the soaring incomes of a handful of superstars in finance and other fields. But that may be yesterday’s story.

More specifically, while it’s true that the finance guys are still making out like bandits — in part because, as we now know, some of them actually are bandits — the wage gap between workers with a college education and those without, which grew a lot in the 1980s and early 1990s, hasn’t changed much since then. Indeed, recent college graduates had stagnant incomes even before the financial crisis struck. Increasingly, profits have been rising at the expense of workers in general, including workers with the skills that were supposed to lead to success in today’s economy.

Why is this happening? As best as I can tell, there are two plausible explanations, both of which could be true to some extent. One is that technology has taken a turn that places labor at a disadvantage; the other is that we’re looking at the effects of a sharp increase in monopoly power. Think of these two stories as emphasizing robots on one side, robber barons on the other.

About the robots: there’s no question that in some high-profile industries, technology is displacing workers of all, or almost all, kinds. For example, one of the reasons some high-technology manufacturing has lately been moving back to the United States is that these days the most valuable piece of a computer, the motherboard, is basically made by robots, so cheap Asian labor is no longer a reason to produce them abroad.

In a recent book, “Race Against the Machine,” M.I.T.’s Erik Brynjolfsson and Andrew McAfee argue that similar stories are playing out in many fields, including services like translation and legal research. What’s striking about their examples is that many of the jobs being displaced are high-skill and high-wage; the downside of technology isn’t limited to menial workers.

Still, can innovation and progress really hurt large numbers of workers, maybe even workers in general? I often encounter assertions that this can’t happen. But the truth is that it can, and serious economists have been aware of this possibility for almost two centuries. The early-19th-century economist David Ricardo is best known for the theory of comparative advantage, which makes the case for free trade; but the same 1817 book in which he presented that theory also included a chapter on how the new, capital-intensive technologies of the Industrial Revolution could actually make workers worse off, at least for a while — which modern scholarship suggests may indeed have happened for several decades.

What about robber barons? We don’t talk much about monopoly power these days; antitrust enforcement largely collapsed during the Reagan years and has never really recovered. Yet Barry Lynn and Phillip Longman of the New America Foundation argue, persuasively in my view, that increasing business concentration could be an important factor in stagnating demand for labor, as corporations use their growing monopoly power to raise prices without passing the gains on to their employees.

I don’t know how much of the devaluation of labor either technology or monopoly explains, in part because there has been so little discussion of what’s going on. I think it’s fair to say that the shift of income from labor to capital has not yet made it into our national discourse.

Yet that shift is happening — and it has major implications. For example, there is a big, lavishly financed push to reduce corporate tax rates; is this really what we want to be doing at a time when profits are surging at workers’ expense? Or what about the push to reduce or eliminate inheritance taxes; if we’re moving back to a world in which financial capital, not skill or education, determines income, do we really want to make it even easier to inherit wealth?

As I said, this is a discussion that has barely begun — but it’s time to get started, before the robots and the robber barons turn our society into something unrecognizable.

http://www.nytimes.com/2012/12/07/opinion/krugman-the-forgotten-millions.html?_r=3&adxnnl=1&partner=rss&emc=rss&adxnnlx=1354885607-Jjys0AIQl5fI3FhblUtB5A&

OP-ED COLUMNIST

The Forgotten Millions

OP-ED COLUMNIST

The Forgotten Millions

By PAUL KRUGMAN

December 6, 2012

Let’s get one thing straight: America is not facing a fiscal crisis. It is, however, still very much experiencing a job crisis.

It’s easy to get confused about the fiscal thing, since everyone’s talking about the “fiscal cliff.” Indeed, one recent poll suggests that a large plurality of the public believes that the budget deficit will go up if we go off that cliff.

In fact, of course, it’s just the opposite: The danger is that the deficit will come down too much, too fast. And the reasons that might happen are purely political; we may be about to slash spending and raise taxes not because markets demand it, but because Republicans have been using blackmail as a bargaining strategy, and the president seems ready to call their bluff.

Moreover, despite years of warnings from the usual suspects about the dangers of deficits and debt, our government can borrow at incredibly low interest rates — interest rates on inflation-protected U.S. bonds are actually negative, so investors are paying our government to make use of their money. And don’t tell me that markets may suddenly turn on us. Remember, the U.S. government can’t run out of cash (it prints the stuff), so the worst that could happen would be a fall in the dollar, which wouldn’t be a terrible thing and might actually help the economy.

Yet there is a whole industry built around the promotion of deficit panic. Lavishly funded corporate groups keep hyping the danger of government debt and the urgency of deficit reduction now now now — except that these same groups are suddenly warning against too much deficit reduction. No wonder the public is confused.

Meanwhile, there is almost no organized pressure to deal with the terrible thing that is actually happening right now — namely, mass unemployment. Yes, we’ve made progress over the past year. But long-term unemployment remains at levels not seen since the Great Depression: as of October, 4.9 million Americans had been unemployed for more than six months, and 3.6 million had been out of work for more than a year.

When you see numbers like those, bear in mind that we’re looking at millions of human tragedies: at individuals and families whose lives are falling apart because they can’t find work, at savings consumed, homes lost and dreams destroyed. And the longer this goes on, the bigger the tragedy.

There are also huge dollars-and-cents costs to our unmet jobs crisis. When willing workers endure forced idleness society as a whole suffers from the waste of their efforts and talents. The Congressional Budget Office estimates that what we are actually producing falls short of what we could and should be producing by around 6 percent of G.D.P., or $900 billion a year.

Worse yet, there are good reasons to believe that high unemployment is undermining our future growth as well, as the long-term unemployed come to be considered unemployable, as investment falters in the face of inadequate sales.

So what can be done? The panic over the fiscal cliff has been revelatory. It shows that even the deficit scolds are closet Keynesians. That is, they believe that right now spending cuts and tax hikes would destroy jobs; it’s impossible to make that claim while denying that temporary spending increases and tax cuts would create jobs. Yes, our still-depressed economy needs more fiscal stimulus.

And, to his credit, President Obama did include a modest amount of stimulus in his initial budget offer; the White House, at least, hasn’t completely forgotten about the unemployed. Unfortunately, almost nobody expects those stimulus plans to be included in whatever deal is eventually reached.

December 6, 2012

Let’s get one thing straight: America is not facing a fiscal crisis. It is, however, still very much experiencing a job crisis.

It’s easy to get confused about the fiscal thing, since everyone’s talking about the “fiscal cliff.” Indeed, one recent poll suggests that a large plurality of the public believes that the budget deficit will go up if we go off that cliff.

In fact, of course, it’s just the opposite: The danger is that the deficit will come down too much, too fast. And the reasons that might happen are purely political; we may be about to slash spending and raise taxes not because markets demand it, but because Republicans have been using blackmail as a bargaining strategy, and the president seems ready to call their bluff.

Moreover, despite years of warnings from the usual suspects about the dangers of deficits and debt, our government can borrow at incredibly low interest rates — interest rates on inflation-protected U.S. bonds are actually negative, so investors are paying our government to make use of their money. And don’t tell me that markets may suddenly turn on us. Remember, the U.S. government can’t run out of cash (it prints the stuff), so the worst that could happen would be a fall in the dollar, which wouldn’t be a terrible thing and might actually help the economy.

Yet there is a whole industry built around the promotion of deficit panic. Lavishly funded corporate groups keep hyping the danger of government debt and the urgency of deficit reduction now now now — except that these same groups are suddenly warning against too much deficit reduction. No wonder the public is confused.

Meanwhile, there is almost no organized pressure to deal with the terrible thing that is actually happening right now — namely, mass unemployment. Yes, we’ve made progress over the past year. But long-term unemployment remains at levels not seen since the Great Depression: as of October, 4.9 million Americans had been unemployed for more than six months, and 3.6 million had been out of work for more than a year.

When you see numbers like those, bear in mind that we’re looking at millions of human tragedies: at individuals and families whose lives are falling apart because they can’t find work, at savings consumed, homes lost and dreams destroyed. And the longer this goes on, the bigger the tragedy.

There are also huge dollars-and-cents costs to our unmet jobs crisis. When willing workers endure forced idleness society as a whole suffers from the waste of their efforts and talents. The Congressional Budget Office estimates that what we are actually producing falls short of what we could and should be producing by around 6 percent of G.D.P., or $900 billion a year.

Worse yet, there are good reasons to believe that high unemployment is undermining our future growth as well, as the long-term unemployed come to be considered unemployable, as investment falters in the face of inadequate sales.

So what can be done? The panic over the fiscal cliff has been revelatory. It shows that even the deficit scolds are closet Keynesians. That is, they believe that right now spending cuts and tax hikes would destroy jobs; it’s impossible to make that claim while denying that temporary spending increases and tax cuts would create jobs. Yes, our still-depressed economy needs more fiscal stimulus.

And, to his credit, President Obama did include a modest amount of stimulus in his initial budget offer; the White House, at least, hasn’t completely forgotten about the unemployed. Unfortunately, almost nobody expects those stimulus plans to be included in whatever deal is eventually reached.

So why aren’t we helping the unemployed? It’s not because we can’t afford it. Given those ultralow borrowing costs, plus the damage unemployment is doing to our economy and hence to the tax base, you can make a pretty good case that spending more to create jobs now would actually improve our long-run fiscal position.Nor, I think, is it really ideology. Even Republicans, when opposing cuts in defense spending, immediately start talking about how such cuts would destroy jobs — and I’m sorry, but weaponized Keynesianism, the assertion that government spending creates jobs, but only if it goes to the military, doesn’t make sense.No, in the end it’s hard to avoid concluding that it’s about class. Influential people in Washington aren’t worried about losing their jobs; by and large they don’t even know anyone who’s unemployed. The plight of the unemployed simply doesn’t loom large in their minds — and, of course, the unemployed don’t hire lobbyists or make big campaign contributions.So the unemployment crisis goes on and on, even though we have both the knowledge and the means to solve it. It’s a vast tragedy — and it’s also an outrage.

http://www.truthdig.com/eartotheground/item/krugman_america_is_not_facing_a_fiscal_crisis_20121207/?ln

Krugman: ‘America Is Not Facing a Fiscal Crisis’

December 7, 2012

Krugman: ‘America Is Not Facing a Fiscal Crisis’

December 7, 2012

Ear To the Ground

Truthdig

r-z (CC BY 2.0)

No, says the Nobel Prize-winning economist, who must be hoarse from repeating the same thing for the last four years: The United States is facing a jobs crisis, one that costs the savings, homes and dreams of millions of Americans and about $900 billion a year in lost productivity.

The tragedy of the loss is compounded by its lack of necessity, Krugman writes. Low interest rates currently enable the government to borrow money that it could use to fund stimulus programs that would put Americans to work. And because the government prints its own money, there’s no risk of running out of it.

Yet many of America’s millionaires and billionaires are set on reducing the deficit that is necessary to fund a stimulus program, even as the nation added a measly 146,000 jobs in November, one-third of which came from the retail sector, which is preparing for the holiday shopping rush. Krugman explains why.

—Posted by Alexander Reed Kelly.

Paul Krugman at The New York Times:

So why aren’t we helping the unemployed? It’s not because we can’t afford it. Given those ultralow borrowing costs, plus the damage unemployment is doing to our economy and hence to the tax base, you can make a pretty good case that spending more to create jobs now would actually improve our long-run fiscal position.

Nor, I think, is it really ideology. Even Republicans, when opposing cuts in defense spending, immediately start talking about how such cuts would destroy jobs — and I’m sorry, but weaponized Keynesianism, the assertion that government spending creates jobs, but only if it goes to the military, doesn’t make sense.

No, in the end it’s hard to avoid concluding that it’s about class. Influential people in Washington aren’t worried about losing their jobs; by and large they don’t even know anyone who’s unemployed. The plight of the unemployed simply doesn’t loom large in their minds — and, of course, the unemployed don’t hire lobbyists or make big campaign contributions.