www.nytimes.com/2009/03/26/us/26franklin.html?ref=obituaries&pagewanted=all

voices.washingtonpost.com/postmortem/2009/03/john_hope_franklin_dies.html?hpid=news-col-blog

news.bbc.co.uk/2/hi/americas/7964747.stm

www.boston.com/news/local/breaking_news/2009/03/john_hope_frank.html?p1=Well_MostPop_Emailed2

http://blogs.usatoday.com/ondeadline/2009/03/revered-histori.html

http://www.duke.edu/johnhopefranklin/

http://www.nytimes.com/2009/03/27/opinion/27fri4.html?_r=1&th&emc=th

All,

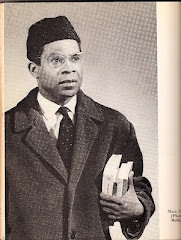

Dr. John Hope Franklin was a great scholar and a true intellectual pioneer, leader, critic, and activist in the field of U.S. history for over six decades. His many contributions to the national and international discourse on the complex dynamics of race, class, and politics have deeply influenced critical thought and social activism in the United States over the past century. His work has served as a beacon and academic benchmark for the critical examination of the multicultural and multiracial realities of the American historical experience within the broader context of political economy, sociology, and philosophy as well as general scientific inquiry in human/social relations. Among his many books, monographs, essays, and articles his signature text and scholarly magnum opus 'From Slavery to Freedom' first published in 1947 and never out of print since then has educated thousands of college students in this country and abroad and has been translated into many languages. His legacy is profound. A very perceptive and dedicated man of quiet dignity, discipline, gravitas, and a gentle, even sly humor and wit Dr. Franklin will be sorely missed by many people throughout this country and the world, and especially by a large international coterie of former and present day students, scholars, and activists whom he mentored and/or inspired over the course of a very long and distinguished career. I am deeply honored to count myself among them.

Kofi

John Hope Franklin, Scholar of African-American History, Is Dead at 94

By ANDREW L. YARROW

March 25, 2009

New York Times

John Hope Franklin, a prolific scholar of African-American history who profoundly influenced thinking about slavery and Reconstruction while helping to further the civil rights struggle, died Wednesday in Durham, N.C. He was 94.

A spokeswoman for Duke University, where Dr. Franklin taught, said he died of congestive heart failure at the university’s hospital.

During a career of scholarship, teaching and advocacy that spanned more than 70 years, Dr. Franklin was deeply involved in the painful debates that helped reshape America’s racial identity, working with the Rev. Dr. Martin Luther King Jr., W. E. B. Du Bois, Thurgood Marshall and other major civil rights figures of the 20th century.

“I will always think of John Hope as the historian of the South who grasped the complexity of Southern public life as shaped by the horror of personal slavery,” said Nell Irvin Painter, the Princeton University historian. “Franklin was the first great American historian to reckon the price owed in violence, autocracy and militarism.”

It was a theme Dr. Franklin wrestled with into his last years. In an article in The Atlantic Monthly in 2007, he wrote, “If the American idea was to fight every war from the beginning of colonization to the middle of the 20th century with Jim Crow armed forces, in the belief that this would promote the American idea of justice and equality, then the American idea was an unmitigated disaster and a denial of the very principles that this country claimed as its rightful heritage.”

Dr. Franklin combined idealism with rigorous research, producing such classic works as “From Slavery to Freedom: A History of African-Americans,” first published in 1947. Considered one of the definitive historical surveys of the American black experience, it has sold more than three million copies and has been translated into Japanese, German, French, Chinese and other languages.

Robert W. Fogel, a Nobel Prize-winning economist at the University of Chicago, called it “a landmark in the interpretation of American civilization.”

Dr. Franklin also taught at some of the nation’s leading institutions, including Harvard and the University of Chicago in addition to Duke, and as a scholar he personally broke several racial barriers.

He often argued that historians have an important role in shaping policy, a position he put into practice when he worked with Marshall’s team of lawyers in their effort to strike down segregation in the landmark 1954 case Brown v. Board of Education, which outlawed the doctrine of “separate but equal” in the nation’s public schools.

“Using the findings of the historians,” Dr. Franklin recalled in a 1974 lecture, “the lawyers argued that the history of segregation laws reveals that their main purpose was to organize the community upon the basis of a superior white and an inferior Negro caste.”

Dr. Franklin also participated in the 1965 march from Selma to Montgomery, Ala., with Dr. King.

“One might argue that the historian is the conscience of the nation, if honesty and consistency are factors that nurture the conscience,” Dr. Franklin said. Still, he warned, if scholars engage in advocacy as well as scholarship they must “make it clear which activity they are engaging in at any given time.”

President Bill Clinton, in awarding him the Medal of Freedom, the nation’s highest civilian honor, in 1995, said Dr. Franklin had never confused “his role as an advocate with his role as a scholar,” adding that he had held “to the conviction that integration is a national necessity.”

Yet even on so august an occasion, Dr. Franklin could not escape the legacy of discrimination. In a talk he gave in North Carolina 10 years later, he recalled that on the evening before he received the medal at the White House, a woman at a Washington club asked him to fetch her coat, mistaking him for an attendant, and that a man at his hotel had handed him car keys and told him to get his car.

Dr. Franklin’s prestige led Mr. Clinton to select him in 1997 to head the Advisory Board to the President’s Initiative on Race, which was formed to promote dialogue about the country’s race problems.

The panel, however, drew criticism. White supremacists protested at some of its forums, and at others American Indians and other minorities complained that they were being left out of the process. A group of conservative scholars repudiated the panel and formed their own.

And when Dr. Franklin’s group finally issued its report after 15 months, the document was criticized as, in one disillusioned scholar’s words, “a list of platitudes.”

The controversy did little to dim Dr. Franklin’s standing as a groundbreaking historian, however. He was the first African-American president of the American Historical Association; the first black department chairman at a predominantly white institution, Brooklyn College; the first black professor to hold an endowed chair at Duke; the first black chairman of the University of Chicago’s history department; and the first African-American to present a paper at the segregated Southern Historical Association, one of many groups that later elected him its president.

John Hope Franklin was born on Jan. 2, 1915, in Rentiesville, Okla., the son of Buck Colbert Franklin, a lawyer, and Molly Parker Franklin, an elementary school teacher. His parents had moved to Rentiesville, an all-black town, after his father was not allowed to practice law in Louisiana.

In the 1920s, the family moved to Tulsa, and at age 11 he was taken to hear the great civil rights leader W. E. B. Du Bois, with whom Dr. Franklin later became friends.

His youth was marked by frequent brushes with racism. He was forced off an all-white train and made to sit in a segregated section of the Tulsa opera house. He watched black neighborhoods of Tulsa — including the one where his father had his office — being burned during the infamous 1921 race riot, and he was barred from admission to the University of Oklahoma.

Instead, Dr. Franklin attended historically black Fisk University in Nashville, receiving his B.A. in 1935. There he met Aurelia E. Whittington, who would become his wife, and sometime editor, of almost 60 years. They had one son, John Whittington Franklin, who survives him. Mrs. Franklin died in 1999.

In 1997, Dr. Franklin and his son edited an autobiography of his father, Buck Franklin. The book told the tale of free blacks in the Southwestern Indian territories in the late 1800s. Buck Franklin’s father, a former slave owned by Indians, became a cowboy and rancher, while Buck, who taught himself law by mail, was an advocate of black pride and nonviolence.

Before graduating from Fisk, Dr. Franklin considered following his father into law but was persuaded by a white professor, Ted Currier, to make history his field. Professor Currier was said to have borrowed $500 to help Dr. Franklin pursue graduate studies at Harvard. There, Dr. Franklin later recalled, he felt the isolation of being one of only a handful of blacks on campus. He received his master’s degree in 1936 and his Ph.D. in 1941.

Two years later he published his first book, “The Free Negro in North Carolina, 1790-1860,” which explored slaveholders’ hatred and fear of the quarter-million free blacks in the antebellum South. Almost 20 other books followed, either written or edited by Dr. Franklin.

In “The Militant South, 1800-1861” (1956), he described Southern whites’ “martial spirit” and “will to fight,” which he said gave the pre-Civil-War South its reputation for violence. He approvingly quoted Tocqueville’s observation that, because of slavery, “the citizen of the Southern states becomes a sort of domestic dictator from infancy.”

In “Reconstruction After the Civil War” (1961), he wrote that the end of Reconstruction reforms left “the South more than ever attached to the values and outlook that had shaped its history.” He lamented that “in the postwar years, the Union had not made the achievements of the war a foundation for the healthy advancement of the political, social and economic life” of the nation.

“The Emancipation Proclamation” (1963), written a century after the proclamation was issued, examined how it evolved in Lincoln’s mind and its impact on the Civil War and later generations. Dr. Franklin concluded hopefully, “Perhaps in its second century, it would give real meaning and purpose to the Declaration of Independence.”

And in “The Color Line: Legacy for the 21st Century” (1993) he argued that race would remain America’s great problem in the 21st century.

Despite his acute awareness of the South’s troubled racial history, Dr. Franklin was often angrier about Northern racism and frequently defended his adopted home state, North Carolina.

His major biographical project was a 1985 study of George Washington Williams, a self-educated black Civil War veteran and author of a 1,000-page 1882 history of blacks in America from 1619 to 1880. He said he spent nearly 40 years of intermittent research on the project, calling Williams “one of the small heroes of the world.”

Dr. Franklin’s first passion was teaching, and he continued to log classroom time despite his increasing prominence. His teaching career began at Fisk in 1936 and continued over the next 20 years at St. Augustine’s College in Raleigh, N.C., North Carolina College in Durham and Howard University in Washington.

As his first books drew national notice, Dr. Franklin left the world of historically black colleges and went to Brooklyn College, where from 1956 to 1964 he served as chairman of what had been an all-white department.

“Having John Hope Franklin at Brooklyn College in the 1960’s was like having a real star in our midst,” said Senator Barbara Boxer, Democrat of California, who was a student of Dr. Franklin’s. “Students who were lucky enough to get into his class bragged about him from morning until night.”

Dr. Franklin later taught at the University of Chicago before returning to North Carolina in 1982 to teach at Duke and at the Duke Law School.

Dr. Franklin was also a Fulbright professor in Australia and had teaching stints in China and Zimbabwe. He taught at Cambridge University in England; Harvard; Cornell; the University of Wisconsin; the University of Hawaii; the University of California, Berkeley; and other institutions. Since 1992, he had been James B. Duke professor emeritus of history at Duke. A John Hope Franklin Research Center was established in his honor at Duke.

At his home in Durham, Dr. Franklin continued a lifelong hobby of cultivating hundreds of orchids; one species was named for him, the Phalaenopsis John Hope Franklin.

His honors, awards, and professional and civic affiliations were so numerous as to fill several single-spaced pages of a long curriculum vitae. He received more than 100 honorary degrees.

In 2006, he received the John W. Kluge Prize for the Study of Humanities in a ceremony at the Library of Congress. In his prepared remarks he said he had long struggled “to understand how it is that we could seek a land of freedom for the people of Europe and, at the very same time, establish a social and economic system that enslaved people who happen not to be from Europe.”

“I have struggled to understand,” he went on, “how it is that we could fight for independence and, at the very same time, use that newly won independence to enslave many who had joined in the fight for independence.

“As a student of history, I have attempted to explain it historically, but that explanation has not been all that satisfactory. That has left me no alternative but to use my knowledge of history, and whatever other knowledge and skills I have, to present the case for change in keeping with the express purpose of attaining the promised goals of equality for all peoples.”

Pioneering historian John Hope Franklin dies at 94

By MARTHA WAGGONER

Associated Press

March 24, 2009

RALEIGH, N.C. (AP) — John Hope Franklin, a towering scholar and pioneer of African-American studies who wrote the seminal text on the black experience in the U.S. and worked on the landmark Supreme Court case that outlawed public school segregation, died Wednesday. He was 94.

David Jarmul, a spokesman at Duke University, where Franklin taught for a decade and was professor emeritus of history, said he died of congestive heart failure at the school's hospital in Durham.

Born and raised in an all-black community in Oklahoma where he was often subjected to humiliating racism, Franklin was later instrumental in bringing down the legal and historical validations of such a world.

As an author, his book "From Slavery to Freedom" was a landmark integration of black history into American history that remains relevant more than 60 years after being published. As a scholar, his research helped Thurgood Marshall and his team at the NAACP win Brown v. Board of Education, the 1954 case that barred the doctrine of "separate but equal" in the nation's public schools.

"It was evident how much the lawyers appreciated what the historians could offer," Franklin later wrote. "For me, and I suspect the same was true for the others, it was exhilarating."

Franklin himself broke numerous color barriers. He was the first black department chair at a predominantly white institution, Brooklyn College; the first black professor to hold an endowed chair at Duke; and the first black president of the American Historical Association.

He often regarded his country like an exasperated relative, frustrated by racism's stubborn power, yet refusing to give up. "I want to be out there on the firing line, helping, directing or doing something to try to make this a better world, a better place to live," Franklin told The Associated Press in 2005.

In November, after Barack Obama broke the ultimate racial barrier in American politics, Franklin called his ascension to the White House "one of the most historic moments, if not the most historic moment, in the history of this country."

"Because of the life John Hope Franklin lived, the public service he rendered, and the scholarship that was the mark of his distinguished career, we all have a richer understanding of who we are as Americans and our journey as a people," Obama said in a statement. "Dr. Franklin will be deeply missed, but his legacy is one that will surely endure."

Obama's achievement fit with Franklin's mission as a historian, to document how blacks lived and served alongside whites from the nation's birth. Black patriots fought at Lexington and Concord, Franklin pointed out in "From Slavery to Freedom," published in 1947. They crossed the Delaware with Washington and explored with Lewis and Clark.

The book sold more than 3.5 million copies and remains required reading in college classrooms. It was based on research Franklin conducted in libraries and archives that didn't allow him to eat lunch or use the bathroom because he was black.

"He was working in a profession that more or less banned him at the outset and ended up its leading practitioner," said Tim Tyson, a history professor at Duke. "And yet, he always managed to keep his grace and his sense of humor."

Late in life, Franklin received more than 130 honorary degrees and the National Association for the Advancement of Colored People's Spingarn Award. In 1993, President Bill Clinton honored Franklin with the Charles Frankel Prize, recognizing scholarly contributions that give "eloquence and meaning ... to our ideas, hopes and dreams as American citizens."

Clinton awarded Franklin the Presidential Medal of Freedom, the nation's highest civilian prize, two years later, and gave him the role for which he was perhaps best known outside academia, as chairman of Clinton's Initiative on Race. It was a job of which Franklin said, "I am not sure this is an honor. It may be a burden."

"John Hope Franklin was one of the most important American historians of the 20th century and one of the people I most admired," Clinton said in a statement. "He graced our country with his life, his scholarship, and his citizenship."

As he aged, Franklin spent more time in the greenhouse behind his home, where he nursed orchids, than in libraries. He fell in love with the flowers because "they're full of challenges, mystery" — the same reasons he fell in love with history.

In June, Franklin had a small role in the movie based on the book "Blood Done Signed My Name," about the public slaying of black man in Oxford in 1970. Tyson, the book's author, said at the time he wanted Franklin in the movie "because of his dignity and his shining intelligence."

Franklin attended historically black Fisk University, where he met Aurelia Whittington, who would be his wife, editor, helpmate and rock for 58 years, until her death in 1999. He planned to follow his father into law, but the lively lectures of a white professor, Ted Currier, convinced him history was his field. Currier borrowed $500 to send Franklin to Harvard University for graduate studies.

Franklin's doctoral thesis was on free blacks in antebellum North Carolina. His wife spent part of their honeymoon in Washington, D.C., at the Census Bureau, helping him finish. The resulting work, "The Free Negro in North Carolina, 1790-1860," earned Franklin his doctorate and, in 1943, became his first published book. Four years later, he took a job at Howard University. It was the same year "From Slavery to Freedom" was published.

Some of his greatest moments of triumph were marred by bigotry.

His joy at being offered the chair of the Brooklyn College history department in 1956 was tempered by his difficulty getting a loan to buy a house in a "white" neighborhood.

When he was to receive the freedom medal, Franklin hosted a party for some friends at Washington's Cosmos Club, of which he had long been a member. A white woman walked up to him, handed him a slip of paper and demanded that he get her coat. He politely told the woman that any of the uniformed attendants, "and they were all in uniform," would be happy to assist her.

Franklin was born Jan. 2, 1915, in the all-black town of Rentiesville, Okla., where his parents moved in the mistaken belief that separation from whites would mean a better life for their young family. But his father's law office was burned in the race riots in Tulsa, Okla., in 1921, along with the rest of the black section of town.

His mother, Mollie, a teacher, began taking him to school with her when he was 3. He could read and write by 5; by 6, he first became aware of the "racial divide separating me from white America."

Franklin, his mother and sister Anne were ejected from a train when his mother refused the conductor's orders to move to the overcrowded "Negro" coach. As they trudged through the woods back to Rentiesville, young John Hope began to cry.

His mother pulled him aside and told him, "There was not a white person on that train or anywhere else who was any better than I was. She admonished me not to waste my energy by fretting but to save it in order to prove that I was as good as any of them."

On the Net:

Duke University's John Hope Franklin Web site:

http://www.duke.edu/johnhopefranklin

John Hope Franklin

voices.washingtonpost.com/postmortem/2009/03/john_hope_franklin_dies.html?hpid=news-col-blog

news.bbc.co.uk/2/hi/americas/7964747.stm

www.boston.com/news/local/breaking_news/2009/03/john_hope_frank.html?p1=Well_MostPop_Emailed2

http://blogs.usatoday.com/ondeadline/2009/03/revered-histori.html

http://www.duke.edu/johnhopefranklin/

http://www.nytimes.com/2009/03/27/opinion/27fri4.html?_r=1&th&emc=th

All,

Dr. John Hope Franklin was a great scholar and a true intellectual pioneer, leader, critic, and activist in the field of U.S. history for over six decades. His many contributions to the national and international discourse on the complex dynamics of race, class, and politics have deeply influenced critical thought and social activism in the United States over the past century. His work has served as a beacon and academic benchmark for the critical examination of the multicultural and multiracial realities of the American historical experience within the broader context of political economy, sociology, and philosophy as well as general scientific inquiry in human/social relations. Among his many books, monographs, essays, and articles his signature text and scholarly magnum opus 'From Slavery to Freedom' first published in 1947 and never out of print since then has educated thousands of college students in this country and abroad and has been translated into many languages. His legacy is profound. A very perceptive and dedicated man of quiet dignity, discipline, gravitas, and a gentle, even sly humor and wit Dr. Franklin will be sorely missed by many people throughout this country and the world, and especially by a large international coterie of former and present day students, scholars, and activists whom he mentored and/or inspired over the course of a very long and distinguished career. I am deeply honored to count myself among them.

Kofi

John Hope Franklin, Scholar of African-American History, Is Dead at 94

By ANDREW L. YARROW

March 25, 2009

New York Times

John Hope Franklin, a prolific scholar of African-American history who profoundly influenced thinking about slavery and Reconstruction while helping to further the civil rights struggle, died Wednesday in Durham, N.C. He was 94.

A spokeswoman for Duke University, where Dr. Franklin taught, said he died of congestive heart failure at the university’s hospital.

During a career of scholarship, teaching and advocacy that spanned more than 70 years, Dr. Franklin was deeply involved in the painful debates that helped reshape America’s racial identity, working with the Rev. Dr. Martin Luther King Jr., W. E. B. Du Bois, Thurgood Marshall and other major civil rights figures of the 20th century.

“I will always think of John Hope as the historian of the South who grasped the complexity of Southern public life as shaped by the horror of personal slavery,” said Nell Irvin Painter, the Princeton University historian. “Franklin was the first great American historian to reckon the price owed in violence, autocracy and militarism.”

It was a theme Dr. Franklin wrestled with into his last years. In an article in The Atlantic Monthly in 2007, he wrote, “If the American idea was to fight every war from the beginning of colonization to the middle of the 20th century with Jim Crow armed forces, in the belief that this would promote the American idea of justice and equality, then the American idea was an unmitigated disaster and a denial of the very principles that this country claimed as its rightful heritage.”

Dr. Franklin combined idealism with rigorous research, producing such classic works as “From Slavery to Freedom: A History of African-Americans,” first published in 1947. Considered one of the definitive historical surveys of the American black experience, it has sold more than three million copies and has been translated into Japanese, German, French, Chinese and other languages.

Robert W. Fogel, a Nobel Prize-winning economist at the University of Chicago, called it “a landmark in the interpretation of American civilization.”

Dr. Franklin also taught at some of the nation’s leading institutions, including Harvard and the University of Chicago in addition to Duke, and as a scholar he personally broke several racial barriers.

He often argued that historians have an important role in shaping policy, a position he put into practice when he worked with Marshall’s team of lawyers in their effort to strike down segregation in the landmark 1954 case Brown v. Board of Education, which outlawed the doctrine of “separate but equal” in the nation’s public schools.

“Using the findings of the historians,” Dr. Franklin recalled in a 1974 lecture, “the lawyers argued that the history of segregation laws reveals that their main purpose was to organize the community upon the basis of a superior white and an inferior Negro caste.”

Dr. Franklin also participated in the 1965 march from Selma to Montgomery, Ala., with Dr. King.

“One might argue that the historian is the conscience of the nation, if honesty and consistency are factors that nurture the conscience,” Dr. Franklin said. Still, he warned, if scholars engage in advocacy as well as scholarship they must “make it clear which activity they are engaging in at any given time.”

President Bill Clinton, in awarding him the Medal of Freedom, the nation’s highest civilian honor, in 1995, said Dr. Franklin had never confused “his role as an advocate with his role as a scholar,” adding that he had held “to the conviction that integration is a national necessity.”

Yet even on so august an occasion, Dr. Franklin could not escape the legacy of discrimination. In a talk he gave in North Carolina 10 years later, he recalled that on the evening before he received the medal at the White House, a woman at a Washington club asked him to fetch her coat, mistaking him for an attendant, and that a man at his hotel had handed him car keys and told him to get his car.

Dr. Franklin’s prestige led Mr. Clinton to select him in 1997 to head the Advisory Board to the President’s Initiative on Race, which was formed to promote dialogue about the country’s race problems.

The panel, however, drew criticism. White supremacists protested at some of its forums, and at others American Indians and other minorities complained that they were being left out of the process. A group of conservative scholars repudiated the panel and formed their own.

And when Dr. Franklin’s group finally issued its report after 15 months, the document was criticized as, in one disillusioned scholar’s words, “a list of platitudes.”

The controversy did little to dim Dr. Franklin’s standing as a groundbreaking historian, however. He was the first African-American president of the American Historical Association; the first black department chairman at a predominantly white institution, Brooklyn College; the first black professor to hold an endowed chair at Duke; the first black chairman of the University of Chicago’s history department; and the first African-American to present a paper at the segregated Southern Historical Association, one of many groups that later elected him its president.

John Hope Franklin was born on Jan. 2, 1915, in Rentiesville, Okla., the son of Buck Colbert Franklin, a lawyer, and Molly Parker Franklin, an elementary school teacher. His parents had moved to Rentiesville, an all-black town, after his father was not allowed to practice law in Louisiana.

In the 1920s, the family moved to Tulsa, and at age 11 he was taken to hear the great civil rights leader W. E. B. Du Bois, with whom Dr. Franklin later became friends.

His youth was marked by frequent brushes with racism. He was forced off an all-white train and made to sit in a segregated section of the Tulsa opera house. He watched black neighborhoods of Tulsa — including the one where his father had his office — being burned during the infamous 1921 race riot, and he was barred from admission to the University of Oklahoma.

Instead, Dr. Franklin attended historically black Fisk University in Nashville, receiving his B.A. in 1935. There he met Aurelia E. Whittington, who would become his wife, and sometime editor, of almost 60 years. They had one son, John Whittington Franklin, who survives him. Mrs. Franklin died in 1999.

In 1997, Dr. Franklin and his son edited an autobiography of his father, Buck Franklin. The book told the tale of free blacks in the Southwestern Indian territories in the late 1800s. Buck Franklin’s father, a former slave owned by Indians, became a cowboy and rancher, while Buck, who taught himself law by mail, was an advocate of black pride and nonviolence.

Before graduating from Fisk, Dr. Franklin considered following his father into law but was persuaded by a white professor, Ted Currier, to make history his field. Professor Currier was said to have borrowed $500 to help Dr. Franklin pursue graduate studies at Harvard. There, Dr. Franklin later recalled, he felt the isolation of being one of only a handful of blacks on campus. He received his master’s degree in 1936 and his Ph.D. in 1941.

Two years later he published his first book, “The Free Negro in North Carolina, 1790-1860,” which explored slaveholders’ hatred and fear of the quarter-million free blacks in the antebellum South. Almost 20 other books followed, either written or edited by Dr. Franklin.

In “The Militant South, 1800-1861” (1956), he described Southern whites’ “martial spirit” and “will to fight,” which he said gave the pre-Civil-War South its reputation for violence. He approvingly quoted Tocqueville’s observation that, because of slavery, “the citizen of the Southern states becomes a sort of domestic dictator from infancy.”

In “Reconstruction After the Civil War” (1961), he wrote that the end of Reconstruction reforms left “the South more than ever attached to the values and outlook that had shaped its history.” He lamented that “in the postwar years, the Union had not made the achievements of the war a foundation for the healthy advancement of the political, social and economic life” of the nation.

“The Emancipation Proclamation” (1963), written a century after the proclamation was issued, examined how it evolved in Lincoln’s mind and its impact on the Civil War and later generations. Dr. Franklin concluded hopefully, “Perhaps in its second century, it would give real meaning and purpose to the Declaration of Independence.”

And in “The Color Line: Legacy for the 21st Century” (1993) he argued that race would remain America’s great problem in the 21st century.

Despite his acute awareness of the South’s troubled racial history, Dr. Franklin was often angrier about Northern racism and frequently defended his adopted home state, North Carolina.

His major biographical project was a 1985 study of George Washington Williams, a self-educated black Civil War veteran and author of a 1,000-page 1882 history of blacks in America from 1619 to 1880. He said he spent nearly 40 years of intermittent research on the project, calling Williams “one of the small heroes of the world.”

Dr. Franklin’s first passion was teaching, and he continued to log classroom time despite his increasing prominence. His teaching career began at Fisk in 1936 and continued over the next 20 years at St. Augustine’s College in Raleigh, N.C., North Carolina College in Durham and Howard University in Washington.

As his first books drew national notice, Dr. Franklin left the world of historically black colleges and went to Brooklyn College, where from 1956 to 1964 he served as chairman of what had been an all-white department.

“Having John Hope Franklin at Brooklyn College in the 1960’s was like having a real star in our midst,” said Senator Barbara Boxer, Democrat of California, who was a student of Dr. Franklin’s. “Students who were lucky enough to get into his class bragged about him from morning until night.”

Dr. Franklin later taught at the University of Chicago before returning to North Carolina in 1982 to teach at Duke and at the Duke Law School.

Dr. Franklin was also a Fulbright professor in Australia and had teaching stints in China and Zimbabwe. He taught at Cambridge University in England; Harvard; Cornell; the University of Wisconsin; the University of Hawaii; the University of California, Berkeley; and other institutions. Since 1992, he had been James B. Duke professor emeritus of history at Duke. A John Hope Franklin Research Center was established in his honor at Duke.

At his home in Durham, Dr. Franklin continued a lifelong hobby of cultivating hundreds of orchids; one species was named for him, the Phalaenopsis John Hope Franklin.

His honors, awards, and professional and civic affiliations were so numerous as to fill several single-spaced pages of a long curriculum vitae. He received more than 100 honorary degrees.

In 2006, he received the John W. Kluge Prize for the Study of Humanities in a ceremony at the Library of Congress. In his prepared remarks he said he had long struggled “to understand how it is that we could seek a land of freedom for the people of Europe and, at the very same time, establish a social and economic system that enslaved people who happen not to be from Europe.”

“I have struggled to understand,” he went on, “how it is that we could fight for independence and, at the very same time, use that newly won independence to enslave many who had joined in the fight for independence.

“As a student of history, I have attempted to explain it historically, but that explanation has not been all that satisfactory. That has left me no alternative but to use my knowledge of history, and whatever other knowledge and skills I have, to present the case for change in keeping with the express purpose of attaining the promised goals of equality for all peoples.”

Pioneering historian John Hope Franklin dies at 94

By MARTHA WAGGONER

Associated Press

March 24, 2009

RALEIGH, N.C. (AP) — John Hope Franklin, a towering scholar and pioneer of African-American studies who wrote the seminal text on the black experience in the U.S. and worked on the landmark Supreme Court case that outlawed public school segregation, died Wednesday. He was 94.

David Jarmul, a spokesman at Duke University, where Franklin taught for a decade and was professor emeritus of history, said he died of congestive heart failure at the school's hospital in Durham.

Born and raised in an all-black community in Oklahoma where he was often subjected to humiliating racism, Franklin was later instrumental in bringing down the legal and historical validations of such a world.

As an author, his book "From Slavery to Freedom" was a landmark integration of black history into American history that remains relevant more than 60 years after being published. As a scholar, his research helped Thurgood Marshall and his team at the NAACP win Brown v. Board of Education, the 1954 case that barred the doctrine of "separate but equal" in the nation's public schools.

"It was evident how much the lawyers appreciated what the historians could offer," Franklin later wrote. "For me, and I suspect the same was true for the others, it was exhilarating."

Franklin himself broke numerous color barriers. He was the first black department chair at a predominantly white institution, Brooklyn College; the first black professor to hold an endowed chair at Duke; and the first black president of the American Historical Association.

He often regarded his country like an exasperated relative, frustrated by racism's stubborn power, yet refusing to give up. "I want to be out there on the firing line, helping, directing or doing something to try to make this a better world, a better place to live," Franklin told The Associated Press in 2005.

In November, after Barack Obama broke the ultimate racial barrier in American politics, Franklin called his ascension to the White House "one of the most historic moments, if not the most historic moment, in the history of this country."

"Because of the life John Hope Franklin lived, the public service he rendered, and the scholarship that was the mark of his distinguished career, we all have a richer understanding of who we are as Americans and our journey as a people," Obama said in a statement. "Dr. Franklin will be deeply missed, but his legacy is one that will surely endure."

Obama's achievement fit with Franklin's mission as a historian, to document how blacks lived and served alongside whites from the nation's birth. Black patriots fought at Lexington and Concord, Franklin pointed out in "From Slavery to Freedom," published in 1947. They crossed the Delaware with Washington and explored with Lewis and Clark.

The book sold more than 3.5 million copies and remains required reading in college classrooms. It was based on research Franklin conducted in libraries and archives that didn't allow him to eat lunch or use the bathroom because he was black.

"He was working in a profession that more or less banned him at the outset and ended up its leading practitioner," said Tim Tyson, a history professor at Duke. "And yet, he always managed to keep his grace and his sense of humor."

Late in life, Franklin received more than 130 honorary degrees and the National Association for the Advancement of Colored People's Spingarn Award. In 1993, President Bill Clinton honored Franklin with the Charles Frankel Prize, recognizing scholarly contributions that give "eloquence and meaning ... to our ideas, hopes and dreams as American citizens."

Clinton awarded Franklin the Presidential Medal of Freedom, the nation's highest civilian prize, two years later, and gave him the role for which he was perhaps best known outside academia, as chairman of Clinton's Initiative on Race. It was a job of which Franklin said, "I am not sure this is an honor. It may be a burden."

"John Hope Franklin was one of the most important American historians of the 20th century and one of the people I most admired," Clinton said in a statement. "He graced our country with his life, his scholarship, and his citizenship."

As he aged, Franklin spent more time in the greenhouse behind his home, where he nursed orchids, than in libraries. He fell in love with the flowers because "they're full of challenges, mystery" — the same reasons he fell in love with history.

In June, Franklin had a small role in the movie based on the book "Blood Done Signed My Name," about the public slaying of black man in Oxford in 1970. Tyson, the book's author, said at the time he wanted Franklin in the movie "because of his dignity and his shining intelligence."

Franklin attended historically black Fisk University, where he met Aurelia Whittington, who would be his wife, editor, helpmate and rock for 58 years, until her death in 1999. He planned to follow his father into law, but the lively lectures of a white professor, Ted Currier, convinced him history was his field. Currier borrowed $500 to send Franklin to Harvard University for graduate studies.

Franklin's doctoral thesis was on free blacks in antebellum North Carolina. His wife spent part of their honeymoon in Washington, D.C., at the Census Bureau, helping him finish. The resulting work, "The Free Negro in North Carolina, 1790-1860," earned Franklin his doctorate and, in 1943, became his first published book. Four years later, he took a job at Howard University. It was the same year "From Slavery to Freedom" was published.

Some of his greatest moments of triumph were marred by bigotry.

His joy at being offered the chair of the Brooklyn College history department in 1956 was tempered by his difficulty getting a loan to buy a house in a "white" neighborhood.

When he was to receive the freedom medal, Franklin hosted a party for some friends at Washington's Cosmos Club, of which he had long been a member. A white woman walked up to him, handed him a slip of paper and demanded that he get her coat. He politely told the woman that any of the uniformed attendants, "and they were all in uniform," would be happy to assist her.

Franklin was born Jan. 2, 1915, in the all-black town of Rentiesville, Okla., where his parents moved in the mistaken belief that separation from whites would mean a better life for their young family. But his father's law office was burned in the race riots in Tulsa, Okla., in 1921, along with the rest of the black section of town.

His mother, Mollie, a teacher, began taking him to school with her when he was 3. He could read and write by 5; by 6, he first became aware of the "racial divide separating me from white America."

Franklin, his mother and sister Anne were ejected from a train when his mother refused the conductor's orders to move to the overcrowded "Negro" coach. As they trudged through the woods back to Rentiesville, young John Hope began to cry.

His mother pulled him aside and told him, "There was not a white person on that train or anywhere else who was any better than I was. She admonished me not to waste my energy by fretting but to save it in order to prove that I was as good as any of them."

On the Net:

Duke University's John Hope Franklin Web site:

http://www.duke.edu/johnhopefranklin

John Hope Franklin

Updated: March 25, 2009

By Andrew L. Yarrow

John Hope Franklin was a prolific scholar of African-American history who profoundly influenced thinking about slavery and Reconstruction. He died March 25, 2009, in Durham, N.C. He was 94.

During a career of scholarship, teaching and advocacy that spanned more than six decades, Dr. Franklin was deeply involved in the painful debates that helped reshape America's racial identity, working with the Rev. Dr. Martin Luther King Jr., W.E.B. Du Bois, Thurgood Marshall and other giants of the 20th century.

Dr. Franklin combined idealism about the historian's capacity for positively influencing policy with rigorous research and analysis of African-American and American history, producing such classic works as "From Slavery to Freedom: A History of African-Americans," which has sold more than three million copies. He taught at some of the nation's leading institutions, including Duke, Harvard and the University of Chicago, and as a scholar personally broke several racial barriers.

Dr. Franklin often argued that historians had an important role in shaping policy, and no example was more personally salient than his experience with Thurgood Marshall's team of lawyers as they worked to strike down segregation in the landmark 1954 case Brown v. Board of Education. As he recalled in a 1974 lecture, "Using the findings of the historians, the lawyers argued that the history of segregation laws reveals that their main purpose was to organize the community upon the basis of a superior white and an inferior Negro caste."

John Hope Franklin was born on Jan. 2, 1915, in Rentiesville, Okla., the son of Buck Franklin, a lawyer, and Molly Parker Franklin, an elementary school teacher. His parents had moved to Rentiesville, an all-black town, after his father was not allowed to practice law in Louisiana.

In the 1920s, the family moved to Tulsa, where, Dr. Franklin recalled in a 1997 interview with National Public Radio, his parents "always taught us that we were as good as anybody else" and that "race from their point of view meant nothing." At age 11 he was taken to hear the great civil rights leader and intellectual W.E.B. Du Bois, with whom Dr. Franklin later became friends.

Barred from admission to the University of Oklahoma, Dr. Franklin attended historically black Fisk University in Nashville, receiving his B.A. in 1935. He went on to Harvard, later recalling the isolation of being one of just a handful of blacks there. He received his master's degree in 1936 and his Ph.D. in 1941.

He married Aurelia E. Whittington in 1940, and they had one son, John.

John Hope Franklin, Scholar of African-American History, Is Dead at 94

By ANDREW L. YARROW

Mr. Franklin was a prolific scholar of African-American history who profoundly influenced thinking about slavery and Reconstruction while helping to further the civil rights struggle.

Two History Scholars Are to Split $1 Million Award

By DINITIA SMITH

John Hope Franklin and Yu Ying-shih will share this year’s John W. Kluge Prize for the Study of Humanity.

One Man's Memory of What the Nation Wants to Forget

By BRENT STAPLES

John Hope Franklin's memoir, "Mirror to America," offers a portrait of one black family's struggle to serve with honor in a nation that regarded them as less than fully human.

June 10, 2006

Making History

By DAVID OSHINSKY

A memoir by a scholar who fundamentally altered the way Americans view their past.

November 27, 2005

Awash in Inequity

By DEBORAH SOLOMON

The pioneering African-American scholar talks about the continuing problem of segregation, the legacy of Katrina and writing, cooking and working at age 90.

September 18, 2005

MORE ON JOHN HOPE FRANKLIN AND: WRITING AND WRITERS, BLACKS, DUKE UNIVERSITY

February 20, 2000

2 Works Win History Prize

Lincoln Prize for books or films about Civil War will be shared by Allen C Guelzo for Abraham Lincoln: Redeemer President and John Hope Franklin and Loren Schweninger for Runaway Slaves: Rebels on the Plantation

One More River to Cross

By BENJAMIN SCHWARZ

Benjamin Schwarz reviews book Runaway Slaves: Rebels on the Plantation by John Hope Franklin and Loren Schweninger

SEARCH 38 ARTICLES ABOUT JOHN HOPE FRANKLIN:

March 27, 2009

EDITORIAL

John Hope Franklin

By BRENT STAPLES

By Andrew L. Yarrow

John Hope Franklin was a prolific scholar of African-American history who profoundly influenced thinking about slavery and Reconstruction. He died March 25, 2009, in Durham, N.C. He was 94.

During a career of scholarship, teaching and advocacy that spanned more than six decades, Dr. Franklin was deeply involved in the painful debates that helped reshape America's racial identity, working with the Rev. Dr. Martin Luther King Jr., W.E.B. Du Bois, Thurgood Marshall and other giants of the 20th century.

Dr. Franklin combined idealism about the historian's capacity for positively influencing policy with rigorous research and analysis of African-American and American history, producing such classic works as "From Slavery to Freedom: A History of African-Americans," which has sold more than three million copies. He taught at some of the nation's leading institutions, including Duke, Harvard and the University of Chicago, and as a scholar personally broke several racial barriers.

Dr. Franklin often argued that historians had an important role in shaping policy, and no example was more personally salient than his experience with Thurgood Marshall's team of lawyers as they worked to strike down segregation in the landmark 1954 case Brown v. Board of Education. As he recalled in a 1974 lecture, "Using the findings of the historians, the lawyers argued that the history of segregation laws reveals that their main purpose was to organize the community upon the basis of a superior white and an inferior Negro caste."

John Hope Franklin was born on Jan. 2, 1915, in Rentiesville, Okla., the son of Buck Franklin, a lawyer, and Molly Parker Franklin, an elementary school teacher. His parents had moved to Rentiesville, an all-black town, after his father was not allowed to practice law in Louisiana.

In the 1920s, the family moved to Tulsa, where, Dr. Franklin recalled in a 1997 interview with National Public Radio, his parents "always taught us that we were as good as anybody else" and that "race from their point of view meant nothing." At age 11 he was taken to hear the great civil rights leader and intellectual W.E.B. Du Bois, with whom Dr. Franklin later became friends.

Barred from admission to the University of Oklahoma, Dr. Franklin attended historically black Fisk University in Nashville, receiving his B.A. in 1935. He went on to Harvard, later recalling the isolation of being one of just a handful of blacks there. He received his master's degree in 1936 and his Ph.D. in 1941.

He married Aurelia E. Whittington in 1940, and they had one son, John.

John Hope Franklin, Scholar of African-American History, Is Dead at 94

By ANDREW L. YARROW

Mr. Franklin was a prolific scholar of African-American history who profoundly influenced thinking about slavery and Reconstruction while helping to further the civil rights struggle.

Two History Scholars Are to Split $1 Million Award

By DINITIA SMITH

John Hope Franklin and Yu Ying-shih will share this year’s John W. Kluge Prize for the Study of Humanity.

One Man's Memory of What the Nation Wants to Forget

By BRENT STAPLES

John Hope Franklin's memoir, "Mirror to America," offers a portrait of one black family's struggle to serve with honor in a nation that regarded them as less than fully human.

June 10, 2006

Making History

By DAVID OSHINSKY

A memoir by a scholar who fundamentally altered the way Americans view their past.

November 27, 2005

Awash in Inequity

By DEBORAH SOLOMON

The pioneering African-American scholar talks about the continuing problem of segregation, the legacy of Katrina and writing, cooking and working at age 90.

September 18, 2005

MORE ON JOHN HOPE FRANKLIN AND: WRITING AND WRITERS, BLACKS, DUKE UNIVERSITY

February 20, 2000

2 Works Win History Prize

Lincoln Prize for books or films about Civil War will be shared by Allen C Guelzo for Abraham Lincoln: Redeemer President and John Hope Franklin and Loren Schweninger for Runaway Slaves: Rebels on the Plantation

One More River to Cross

By BENJAMIN SCHWARZ

Benjamin Schwarz reviews book Runaway Slaves: Rebels on the Plantation by John Hope Franklin and Loren Schweninger

SEARCH 38 ARTICLES ABOUT JOHN HOPE FRANKLIN:

March 27, 2009

EDITORIAL

John Hope Franklin

By BRENT STAPLES

Every death leaves a conversation unfinished. The one I regret not finishing with the historian John Hope Franklin, who died Wednesday at the age of 94, focused on what it was like to be a rising black intellectual in the Jim Crow South. In particular, I wanted to hear more about Dec. 7, 1941, the day he and his wife, Aurelia, drove from Charleston, S.C., to Raleigh, N.C. — covering the better part of two states — before they reached home and learned that the Japanese had bombed Pearl Harbor.

Clearly, the car had no radio. But wouldn’t they have heard the news when they stopped to gas up and get something eat? No, he said; I had misunderstood the period. Black families motoring through the Jim Crow South packed box lunches to avoid the humiliation of being turned away from restaurants. They relieved themselves in roadside ditches because service-station restrooms were often closed to them. They worried incessantly about breakdowns and flat tires that could leave them stranded at the mercy of bigots who demeaned and wished them ill.

“You took your life into your hands every time you went out on the road,” he said. It was, of course, a relief to come upon a black-owned service station. But he said that you could drive from Charleston quite nearly to Baltimore before finding one.

We had that conversation in 2006, in connection with an article I wrote for this page on his powerful autobiography “Mirror to America.” I had known him for more than 30 years by that time. I had long been aware that he had reshaped the scholarship of the South and had given birth to African-American history with books such as “From Slavery to Freedom,” “The Militant South, 1800-1860” and his groundbreaking work on free Negroes in antebellum North Carolina.

I first met him as a student during the 1970s — a time of big hair and loud voices — when young radicals too often dismissed distinguished black elders as Uncle Toms. This was a mistake based on the fashion of the moment. The older I got, the more we talked. And the more we talked, the more I became attuned to the fierce militancy that burned in his voice and in his prose.

He continued to speak out against injustice and never let himself be flattered into the role of the black factotum who would conveniently declare the race problem solved. If anything, the militancy grew fiercer over time. It reached its zenith in “Mirror to America,” which recounts in vivid detail how the decision to segregate the armed forces poisoned American civic culture. He refused to serve during World War II for a country “that had no respect for me [and] little interest in my well-being.”

I had hoped to sit down with him one more time to reconstruct that trip back in 1941. I must now do that without him.

BRENT STAPLES

Copyright 2009 The New York Times Company

Clearly, the car had no radio. But wouldn’t they have heard the news when they stopped to gas up and get something eat? No, he said; I had misunderstood the period. Black families motoring through the Jim Crow South packed box lunches to avoid the humiliation of being turned away from restaurants. They relieved themselves in roadside ditches because service-station restrooms were often closed to them. They worried incessantly about breakdowns and flat tires that could leave them stranded at the mercy of bigots who demeaned and wished them ill.

“You took your life into your hands every time you went out on the road,” he said. It was, of course, a relief to come upon a black-owned service station. But he said that you could drive from Charleston quite nearly to Baltimore before finding one.

We had that conversation in 2006, in connection with an article I wrote for this page on his powerful autobiography “Mirror to America.” I had known him for more than 30 years by that time. I had long been aware that he had reshaped the scholarship of the South and had given birth to African-American history with books such as “From Slavery to Freedom,” “The Militant South, 1800-1860” and his groundbreaking work on free Negroes in antebellum North Carolina.

I first met him as a student during the 1970s — a time of big hair and loud voices — when young radicals too often dismissed distinguished black elders as Uncle Toms. This was a mistake based on the fashion of the moment. The older I got, the more we talked. And the more we talked, the more I became attuned to the fierce militancy that burned in his voice and in his prose.

He continued to speak out against injustice and never let himself be flattered into the role of the black factotum who would conveniently declare the race problem solved. If anything, the militancy grew fiercer over time. It reached its zenith in “Mirror to America,” which recounts in vivid detail how the decision to segregate the armed forces poisoned American civic culture. He refused to serve during World War II for a country “that had no respect for me [and] little interest in my well-being.”

I had hoped to sit down with him one more time to reconstruct that trip back in 1941. I must now do that without him.

BRENT STAPLES

Copyright 2009 The New York Times Company